What happened to the U.S. stock market?

In recent times, the falling U.S. stocks have attracted everyone’s attention; in addition to technology stocks, relatively stable consumer stocks have also been hit and have repeatedly refreshed the record of consecutive declines.

In everyone’s impression, the U.S. stock market is representative of longevity, so what has happened to the US stock market that has been so tragic this year?

Since mid-March, the Russia-Ukraine conflict has led to a spike in commodity prices. The continued surge in inflation has also led to market expectations that the Fed will accelerate its turn into a hawk.

The Fed kicked off its first-rate hike in March, and the May meeting identified a combination of rate hikes and balance sheet reductions, with the primary goal of curbing inflation. The aggressive monetary policy weighed heavily on the stock market, triggering a rapid decline in U.S. stocks.

After the 50bp rate hike landed in May, coupled with Powell's emphasis on multiple occasions that the interest rates were still raised by 50bp in June and July, concerns about policy tightening eased slightly. Still, recession concerns dominated the market, which is the main reason for the recent sharp decline in US stocks.

Inflation peaked and U.S. stocks bottomed out and rebounded?

Last week, the U.S. Department of Commerce released the PCE price index for April, which rose less than expected.

After the release of the data, the U.S. stock market rebounded, the market believes that the monthly growth of PCE and CPI has shown signs of slowing, inflation may have peaked, and the Fed’s rate hike is expected to cool down. The Fed’s policy tone has the possibility of marginal dovishness.

But a few rebounds may be a mirror image, and after last week's rally in the US stock market, Wall Street began to pour cold water collectively, saying that any rebound in the US stock market may be short-lived.

The U.S. stock market may not be finished because stubborn inflation remains a significant risk to the economy and businesses.

As Wall Street warned, after the latest non-farm payrolls data released by the Department of Labor on June 3, the US stock market has encountered another shock and does not seem to have completely come out of the “darkest hour”.

The report points out that U.S. employment growth remains healthy and the labor market remains tight, which may not change the Fed's outlook for further aggressive rate hikes.

As the non-farm payrolls data is stronger than expected, in addition to consolidating the market for the Fed’s expectations of a 50-basis point rate hike in June and July, there were also voices to maintain a 50-basis point rate hike in September.

The 10-year Treasury yield returned to more than two-week highs on Friday, with the three major stock indexes closing down collectively for the third time in four trading sessions this week amid stronger expectations of a sharp Fed rate hike.

The market’s next focus is on the May CPI consumer inflation data released next Friday. Only after the real inflation decelerates and the real inflection point can the Fed slow down the “water collection” pace.

Federal Reserve is the key

As mentioned above, the main reason for the sharp pullback in U.S. stocks is still due to the rising expectations of the Fed's interest rate hikes.

How the stock market's performance relates to inflation depends largely on whether a peak in inflation is seen as a sign of the end of the rate hike cycle.

The reasons for the recent rise and fall can be found in the current state of “good economic news equals bad news for the market” in the current U.S. stock market. The stock market decline has increased because investors are ready for a pessimistic situation.

Only poor macroeconomic data can make the Fed slow down the pace of tightening; At present, several Fed officials have hinted that they will not suspend interest rate hikes in September this year, but will likely continue to raise rates by 50 basis points, which will bring further resistance to the recent stock market rally.

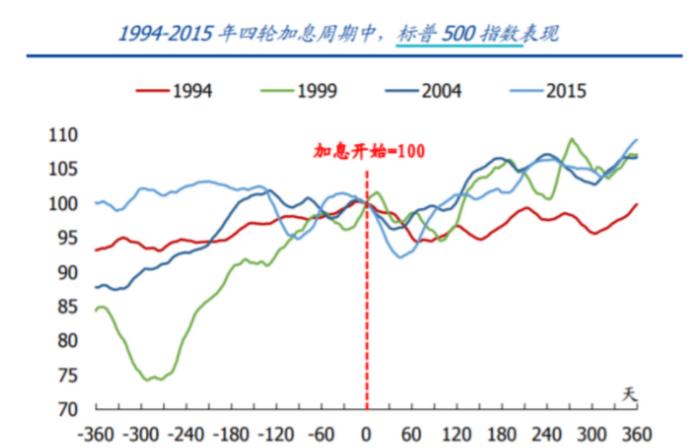

Historically, the S&P 500 in the last five rate hike cycles have all ended in a "rise". However, the macroeconomic conditions, inflation, and employment conditions faced by the Fed in each rate hike cycle are not the same, and the S&P 500 has achieved positive returns.

What's more, U.S. stocks typically fall within three months of the start of rate hikes and mostly regain ground after three months in response to an adequate tightening.

However, in terms of this round of interest rate hikes, the current high inflation is still difficult to say the peak; when the decline can end, the Federal Reserve is the key.

Articles Sharing:

![]() Is Inflation Peaking? Three signs

show that prices are about to fall back

Is Inflation Peaking? Three signs

show that prices are about to fall back

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1104