Dreaming back to the 1970s

On Wednesday, the Federal Reserve raised the interest rate by 75 basis point, which is the biggest move in nearly three decades to curb high inflation.

Recently, inflation has been at 40-year highs for many months in what could be called a “protracted” period of high inflation, which recalls the unprecedented stagflation crisis that erupted in the 1970s.

At that time, the U.S. inflation rate once soared to 15%, GDP growth plummeted, unemployment rate soared. However, the Federal Reserve wavered between dealing with inflation and employment, which resulted in rampant inflation and sluggish economic growth.

It was Paul Volcker, then chairman of the Federal Reserve, who really helped the U.S. get rid of its stagflationary misery in the 1980s - he prevailed over all dissenting views and imposed austerity policies with thunderous force. The unemployment rate jumped from 6% to 11% in a short time after raising interest rates above 10%.

Back then, construction workers mailed him giant wooden blocks in protest, car dealers mailed him keys to new cars which no one wanted, and farmers on tractors shout outside the Federal Reserve's white marble building. But none of these have swayed Mr Volcker.

Later, he raised the benchmark interest rate to more than 20%, subduing the very serious inflation at that time, the crisis was able to draw to a close, the economy was pulled back on track, which also laid a foundation for the subsequent decades of prosperity.

Is the Volcker moment coming?

The Fed’s jump in interest rates since March made markets shuddering: the Volcker moment has arrived again.

However, it is interesting that the Fed itself did not clearly convey the 75BP rate hike signal to the market on the eve of this rate meeting, and it is reasonable to say that the operation was somewhat beyond expectation.

But as of June 15, the market has fully priced in this rate hike, on the day when the rate hike landed, the market factored into unfavorable news and U.S. stocks and bonds rose together.

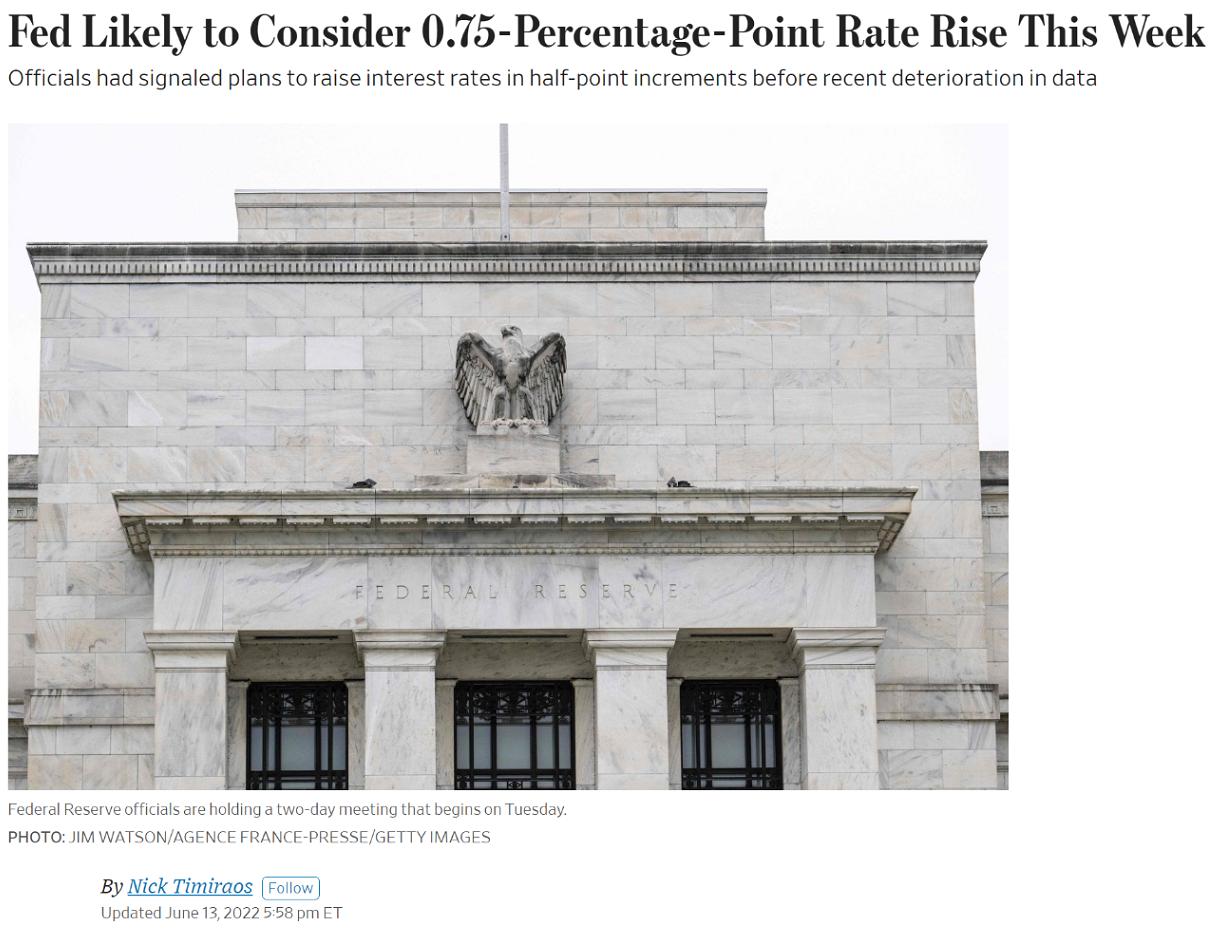

The root causes of this phenomenon are that the CPI data exceeded expectations largely and a report in the Wall Street Journal - a journal known as the “Federal Reserve News Agency”.

The report pointed out that a series of disturbing inflation reports in recent days are likely to lead the Fed officials to consider an unexpected 75 basis point rate hike at this week’s meeting.

The article caused an uproar in the market, and even industry bigwigs Goldman Sachs and JPMorgan followed his lead and revised their forecasts overnight.

The market began to quickly price in a 75 BP rate hike at this rate meeting, and the expected Fed rate hike in June instantly sent the propability of a 75 basis point hike soaring to over 90%, knowing that the figure was only 3.9% a week ago.

Since then, it seems that the Fed is led by the market: it increased the rates by 75 basis points without making any advance “expectations”.

In addition, Powell also released confusing messages at the conference: 75 basis points of rate hikes would not be common to see, but another 75bp hike was likely in July. He thought that consumer inflation expectations are facing risks from the headline inflation, but meanwhile, he also said that the current headline inflation rate didn’t affect expectations in any fundamental way.

Confusing expressions and ambiguous answers as well as the measure of pushing all decisions on the subsequent data made it hard for us to see the similar toughness and firmness in the fight against hyperinflation from Powell as Volcker’s.

So far, what the market fears most is not a rate hike, but a more confusing Fed.

What conditions could end the rate hike?

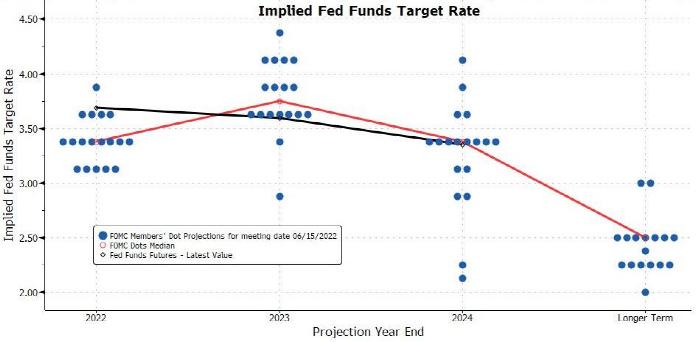

In March, FOMC dot plot showed that the Fed would raise rates gradually over the next two years; while the current FOMC dot plot shows that after a large rate hike during this year and a small rate hike next year, the Fed is expected to start cutting rates the year after next.

But inflation, austerity, growth formed an "impossible triangle", the FOMC re-emphasized that solving inflation is the main objective, if the current primary target is to protect inflation and austerity, then the recession is likely to be inevitable.

Keeping inflation under control is always a game, bearing in mind that Mr Volcker’s actions have been accompanied by two recessions, and he has demonstrated the importance of the Fed maintaining price stability. Only by maintaining price stability will there a be long-term solid growth.

It now seems likely that only a significant improvement in inflation, a sharp rise in unemployment, or an economic or market crisis will deter the Fed

But as more and more agencies issue recession warnings, the market may gradually start to price in downside risks to the economy, and we can expect to see the 10-year U.S. bond yields fall back below 2.5% even before the end of the year.

Howerver, the darkness before the dawn may be the hardest.

Articles Sharing:

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 816