Non-QM Loan

Are you still buying a house for a loan in the United States, do you have to get pay slips and tax declarations? Not checking the income loan tells you that you don't need it at all!If you are operating in the catering industry, service industry in the United States or a group of people with high cash income but insufficient taxation, please bookmark this useful article~

The first thing to be clear is that not checking income loans does not mean that you are not looking at your income or you can have no income. Rather, it is a loan program that does not require checking payroll and tax returns. Today, I will take you to take a look at 6 different non-check income loan programs.

1. DSCR Program

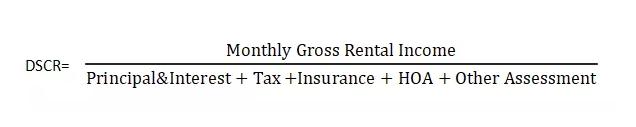

DSCR stands for Debt Service Coverage Ratio, debt service coverage ratio.

It is a kind of loan project measured by the ratio of the monthly rent of the house you want to buy to the monthly repayment amount of the house, land tax, insurance and property management fee. As long as you are buying an investment house and you can get monthly rent, you can make such a loan.

2. VOE Program

The full name of VOE: Verification of employment, proof of employment. You only need your work unit to provide you with a work certificate for the past two years or more. It should be noted that the work unit here must be a work unit that can be found on a third-party search engine, and the bank or lending institution will call the work unit for information verification.

3. P&L Program

The full name of P & L is Profit and Loss, which is the income statement. Generally, banks need CPA for such projects, which is the income statement provided by accountants. And our AAA Lendings also accepts the P&L prepared by the borrower!

4. Asset Based income program

It is a loan program designed based on people who have a balance on the bank statement. The bank will divide your account balance by 6 months as your monthly income, and then compare it with your stated income and take the lower number as your monthly income.

5. Bank Statement Program

For some self-employed people who have continuous cash flow, but the account balance is not very large, then the Bank Statement Program is a good choice. The bank only needs to look at your bank turnover to qualify~ (Currently there are 3 months, 12 months and 24 months bank turnover loan projects for you to choose from.)

6. 6 months Asset depletion Program

This loan program calculates your monthly income by subtracting reserves from your bank deposits and dividing by 84 months. (Assets-Reserves)/84 months = Qualifying income

For general income checking loan plans, you need to calculate your monthly income by subtracting the down payment, handling fees, and reserves from your deposit and dividing it by 240 months.

(Assets-Down Payment-Closing costs-Reserves)/240 months = Qualifying income

Obviously, the monthly income calculated by the plan without checking the income is much higher than that by checking the income, the more loans you can eventually get.