“The danger of this crisis to the overall economy is something that successive policymakers will never forget.”

--Frederic Mishkin, Fed Governor in 1907

Speech to mark the 100th anniversary of the Great Panic

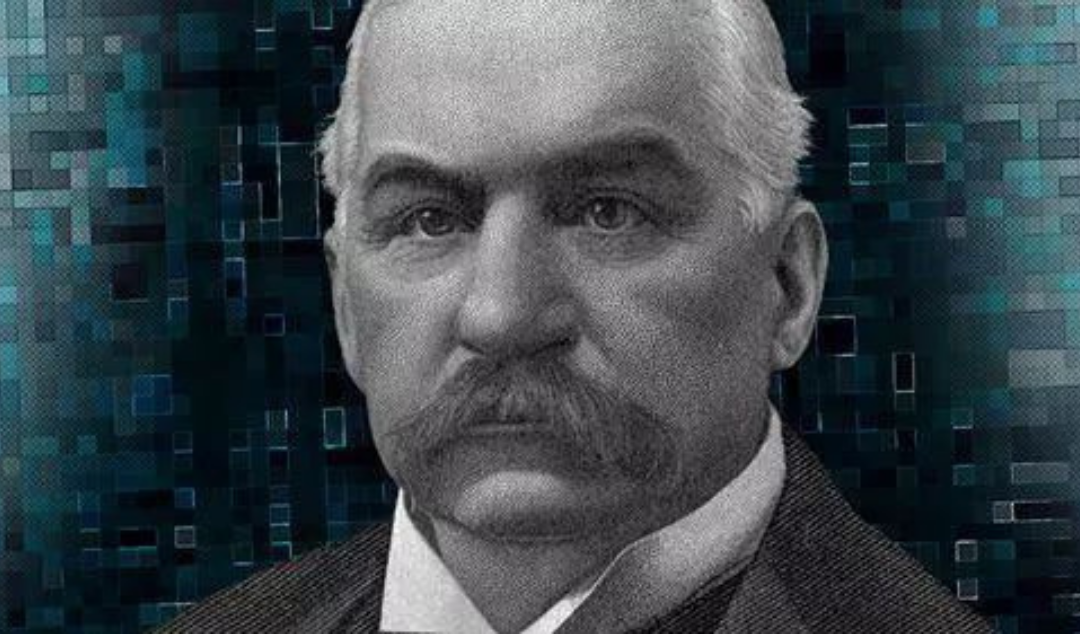

On the mantelpiece in John Pierpont Morgan’s study sits a white porcelain plate made of enamel with a blue inscription in Provençal: “Think deeply, speak carefully, and leave no words behind.”

The taciturn founder of Morgan became a real “silent savior” when the storm came in 1907.

The beginning and end of the 1907 financial crisis (The Great Panic)

In 1906, the United States was still in the tranquil before the storm, but the precursors of the cash crunch had already appeared.

At the beginning of the 20th century, the high economic prosperity of the United States and the increasing demand for capital in the market also prompted excessive borrowing by American institutions and individual investors, which gave rise to a new type of financial institution - the trust and investment company.

The trust companies could do investment business that commercial banks could not do. Still, they lacked government regulation, which allowed them to draw in social capital without restriction and invest in high-risk, high-return industries and the stock market.

In 1906, about half of the bank loans in New York were invested by trust companies as collateral in high-risk stock markets and bonds. The unregulated trust companies made the financial market bubble expand indefinitely.

However, a series of events starting in 1907 made this bubble unsustainable: the outbreak of war in Europe led to a rapid flow of gold capital from the United States back to Europe; In April, the San Francisco earthquake caused severe damage, a large amount of money was used for post-disaster reconstruction, cash is in an emergency.

So the financial markets gradually deteriorated: in June, the New York City municipal bond issue failed; in July, the copper trading market collapsed; in August, the Mobil Oil was fined $29 million; by September, the stock market had fallen by nearly a quarter.

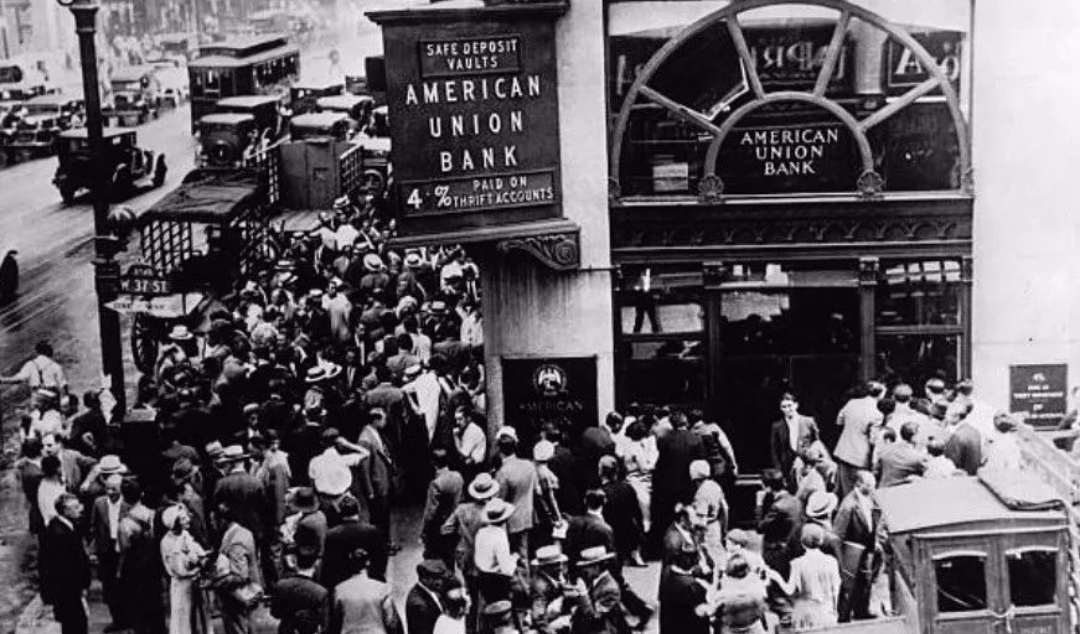

In October, the trigger for this financial crisis finally appeared. The third largest U.S. trust company - Nick Burke Trust Investment Company’s acquisition plan for the United Copper failed. This also became the first dominoes that fueled the great panic. Like the butterfly that set off the giant wave, rumors spread in New York that Knickerbocker was about to go bankrupt.

After the fermentation of public opinion, citizens lined up all night at various trust companies to withdraw money. After the collapse of Knickerbocker, banks worried about the trust company would put them at risk, thus requiring the trust company to repay the loan immediately. The trust companies, dunned by the two sides, have to borrow money from the capital markets at a whopping 150% interest rate.

The panic caused the phenomenon of “shame” among banks, and the flow of funds in the U.S. financial market came to a standstill, the stock market was almost at a standstill, and eight New York banks and trust companies involved in copper stock speculation went bankrupt within four days.

J.P. Morgan - the silent “bailout”

At the onset of the storm, John Pierpont Morgan, the wealthy founder of J.P. Morgan & Company, played the role of “central bank” in the crisis by virtue of his prestige, power and influence, and showed astonishingly power of action.

Morgan formed a coalition of bankers, set up an emergency audit team to assess the losses of the financial institutions in crisis, and provided loans to troubled financial institutions to buy their shares.

Shortly after the crisis broke out, JPMorgan called all the trust company presidents into a conference room and demanded with an iron fist that they fund the bailout of the trusts; in the first bailout of the New York Stock Exchange, JPMorgan raised $25 million in just half an hour.

Morgan injected a powerful wave of confidence into the market with its strong appeal: “Confidence is more valuable than gold to panic”. And JPMorgan, perhaps the bailout is the “savior” to inject certainty into people’s hearts.

After the outbreak of the crisis, from the government to industry organizations, from business leaders to the financial institutions caught in the run, a decisive and powerful bailout penetrated the whole society, and successfully defused the core of the crisis within 3 weeks.

The fact that a private banker organized the response to a nationwide financial crisis is a miracle unparalleled in American economic history, and the crisis has gone down in history as a personal legend for Morgan.

The Federal Reserve emerged from the crisis

The U.S. government briefly established two central bank-like institutions: the First Bank of the United States and the Second Bank of the United States.

But because of the resistance of private bankers to the central bank, both the First and Second Banks were closed after only 20 years of existence, and the U.S. government did not attempt to create an institution like the central bank for more than 70 years

However, after the panic crisis, New York bankers, who had previously believed that a clearing house was sufficient and a central bank was not needed, were very resistant to a central bank, but the financial crisis made him change his position, and people gradually realized that a central bank was required to regulate financial markets.

After the Great Panic of 1907, Senator Aldrich organized a committee to analyze the causes and lessons of the crisis systematically and drafted a proposal advocating that a unified central bank, following the example of European countries, should be established. In case of a financial crisis, emergency loans could be provided to banks that were run into the ground to stabilize the confidence of the financial markets. 1914, the Federal Reserve was officially established.

“History has the property of repeating itself, and it will continue until the lesson is comprehended”.

Imagining the future can only be achieved by deconstructing the past, and although history does not simply repeat itself, we can perhaps draw some inspiration from the rhymes of history

Articles Sharing:

![]() Bubble Or No Bubble? History Tells Us How Likely A Real Estate Crash Is This Year

Bubble Or No Bubble? History Tells Us How Likely A Real Estate Crash Is This Year

![]() Review: How Does $1 Trillion in Cryptocurrencies

Review: How Does $1 Trillion in Cryptocurrencies

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 968