The Federal Reserve Turns to Ease Up

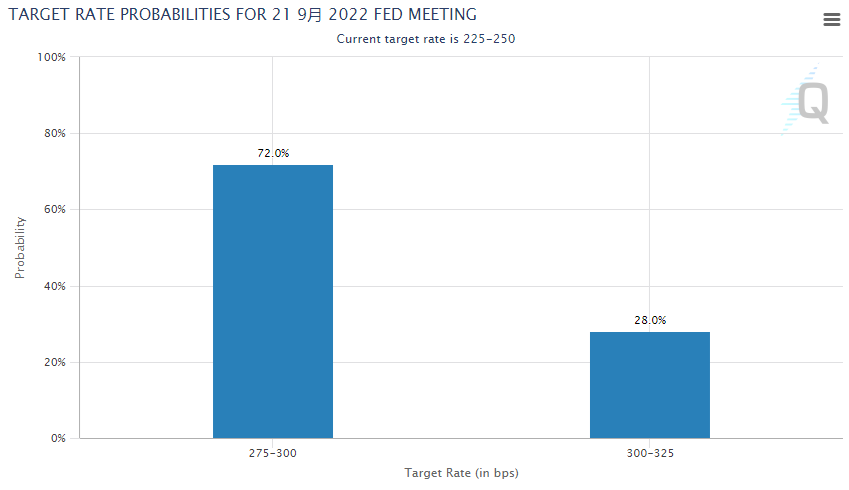

The Federal Reserve announced at the July Federal Open Market Committee (FOMC) meeting that the interest rate would continue to be hiked up 75 basis points, raising the federal funds rate to 2.25%-2.5%.

It was a familiar scene as US Stocks soared and Treasury yields fell as 75 bp duly came. That’s right, it was a similar story at the May and June FOMC meetings.

This is the first time in the past 40 years that the Fed has raised rates by 75 bp in a row. It is fair to say that the Fed has been aggressive enough, but why did the market take the “Rate-Cut” script?

There were two major reasons for the positive market reaction. One is that the rate raise was well within expectations - the consensus for a 75bp hike had been in place before the meeting. The other reason is that the Fed Chairman Powell hinted at the press conference after the meeting: “it likely will become appropriate to slow the pace of the rate increases”.

Powell: It likely will become appropriate to slow the pace of increases.

The mere mention of a “likely will slow the pace if increases” was enough to set off a merriment in the markets, which even seemed to spin a 75bp rise as a “25bp cut”.

With strong expectations management, the Fed has shown us that expectations are far more important than facts once again.

Markets have tended to reverse course the following day after the meeting based on the previous reference, and the Fed’s expectations management may only affect market’s short-term sentiment.

Source: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

So far, however, the market hasn’t shown any signals of turning, and expectations of a slower rate rise seems to be a reasonable interpretation.

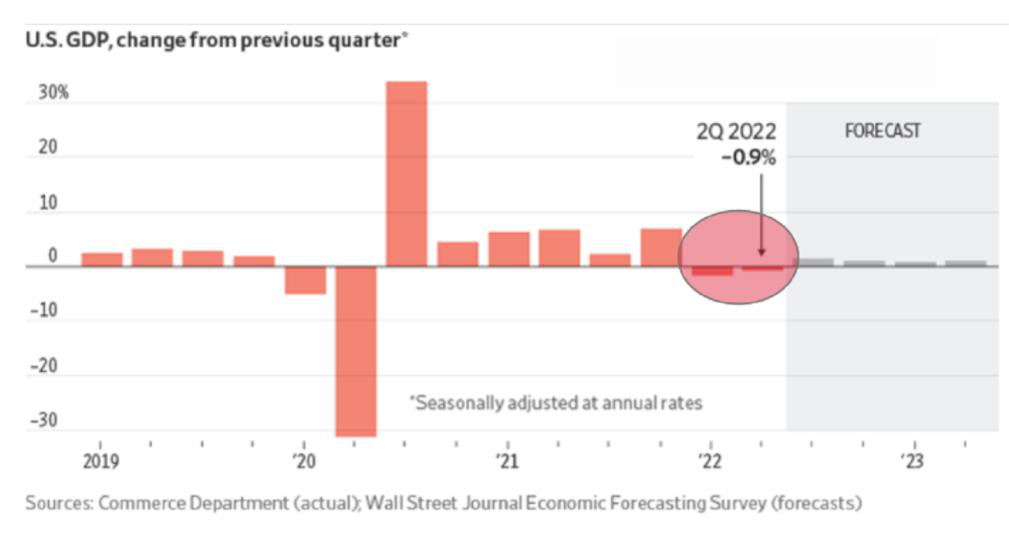

Is there a Recession?

The nation's gross domestic product, a measure of total spending on goods and services across the economy, fell at an annual rate of 0.9%, the Commerce Department said Thursday.

The contraction follows a 1.6% decline in economic activity in the first three months of the year and means the U.S. could currently be in a technical recession - two quarters of falling GDP this year.

In the United States, the group within the NBER that actually makes the call on the recession is the Business Cycle Dating Committee. But the committee’s decisions often come with a lag. (In 2020, the committee didn’t declare a recession until the economy had slumped and 22 million people were out of work for months.)

The NBER is most focused on employment and it looks like the job market in the U.S is red hot. The White House, which has been pushing back on the idea that there is a recession, has pointed out that unemployment is at a historically low rate of 3.6%, even as the Commerce Department has found the economy to have shrunk the last two quarters.

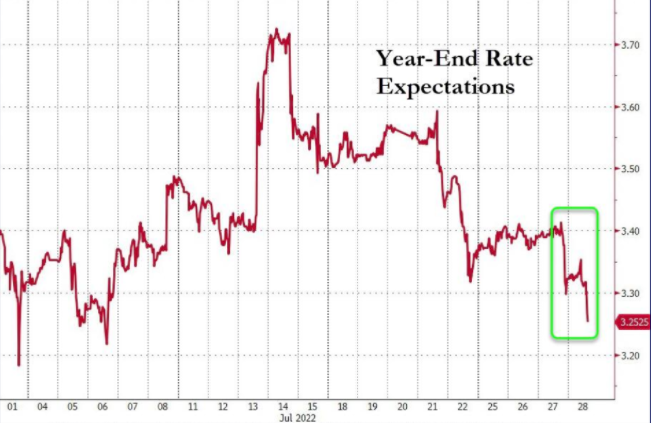

Anyway, there is little doubt that the economy is slowing, and market forecasts for rate rises this year have begun to fall, while expectations of rate cuts have surged.

Wall Street expects rates to reach 3.25% by the end of the year, which means that the remaining three rate hikes in this year will be no more than 90 bp in total.

The Fed looks like it will have to consider whether to forgo another big rate hike.

Will the mortgage rate go down?

The 10-year Treasury yield fell from 2.7% to 2.658%, the lowest since April, as expectations of interest rate hikes continued to fall this year.

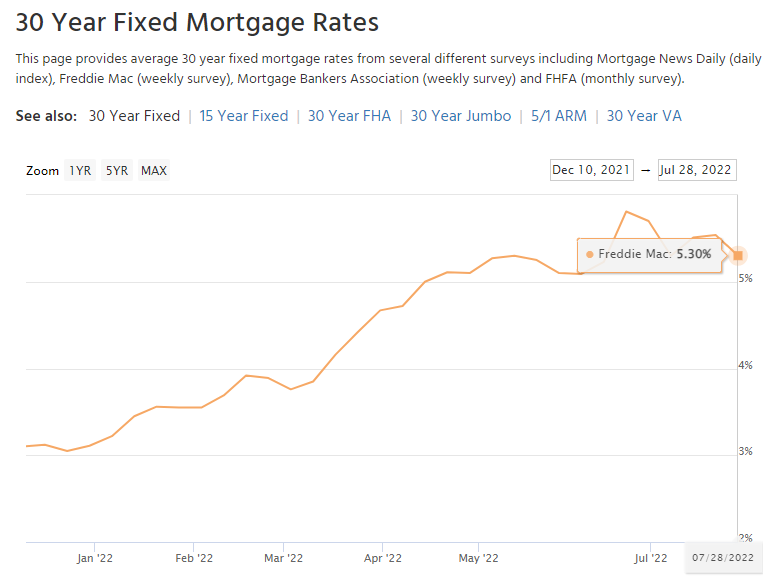

The lasted rate on 30-year mortgage fell back to 5.3% (Freddie Mac)

As things are, the mortgage rate has shown a downward trend, and is likely that the highest point has gone.

The market predict as of now, the Fed’s likely pace of subsequent rate hikes will be as following:

A 50bp hike in September, accompanied by a slowdown trend;

A 25bp hike in November;

A 25bp hike in December and then the rates will fall down next year.

In other words, the Fed could start to slow interest rate hikes as early as September, but the pace of subsequent increases depends on data in July and August.

But if inflation figures don’t come down significantly, the risk of a recession may lead the Fed to raise interest rates to fight the inflation, and mortgage rates are expected to fall further.

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1344