FHA vs Conventional Loan Types: Which is Right for Me?

An FHA loan allows for lower credit scores and can be easier to qualify for than a conventional loan. However, Conventional loans may not require mortgage insurance with a large enough down payment. The benefit of FHA vs conventional down to the individual needs of the borrower.

Let's take a look at both mortgage types to help you decide what's right for you.

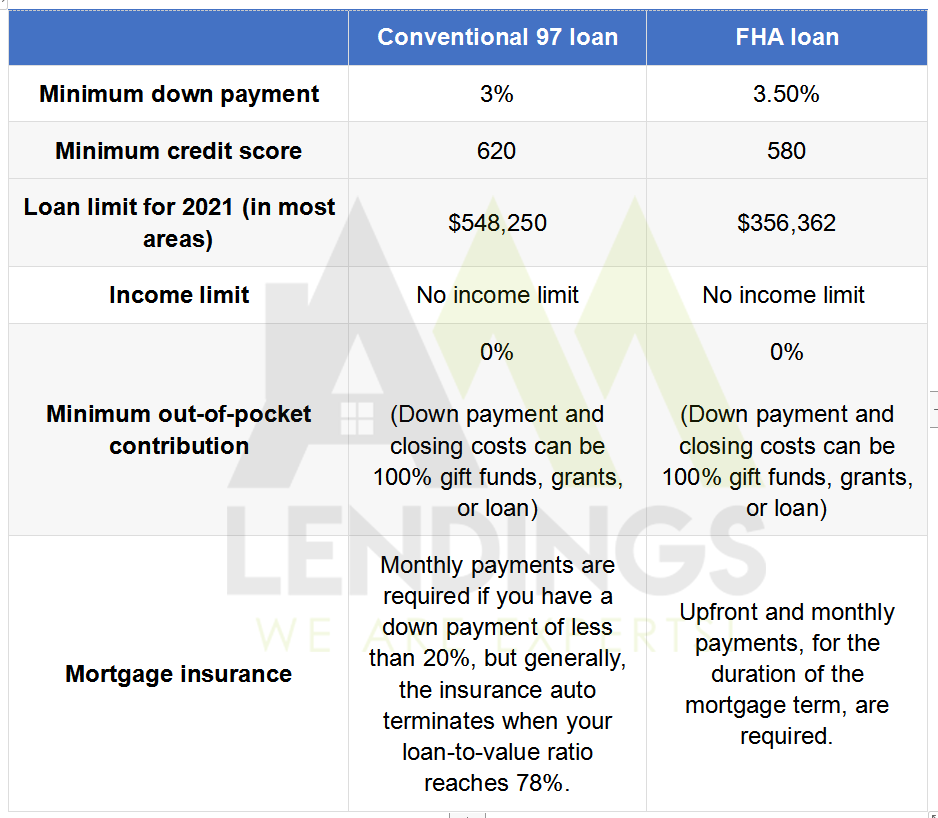

FHA vs Conventional Loans Comparison Chart

FHA vs. Conventional Loans: Key Differences

FHA loans require mortgage insurance regardless of down payment amount, compared to conventional loans where you need mortgage insurance for down payments under 20%. FHA mortgage insurance payments will be the same regardless of your credit score.

FHA Loans

· Lower credit scores allowed

· More rigid property standards

· Somewhat higher down payment needed

· Private Mortgage Insurance (PMI) is required for down payments less than 20%

Conventional Loans

· Higher credit score needed (at least 620)

· Slightly smaller down payments allowed

· Private Mortgage Insurance (PMI) is required for down payments less than 20%

· More liberal property standards

If you are a first-time home buyer or looking to refinance, you are probably asking yourself these kinds of questions. Different situations require different types of loans. In this article, we will take a look at FHA and Conventional loans. Using examples, this article will give you a better understanding of these two types of loans, their benefits and their drawbacks.

AAA 贷款银行是南加州知名的房贷银行,20多年来不断获得各大房地产公司的好评。我们具有自主审阅、独立放款等快捷的贷款流程,从一般的贷款到不查收入以及外国人贷款,我们拥有上百种的方案,迎合不同的市场需求。

阅读原文 阅读 2909