Key Words: Interest rate ,APR

When you’re refinancing or taking out a mortgage, keep in mind that an advertised interest rate isn’t the same as your loan’s annual percentage rate (APR). What’s the difference?

· Interest rate refers to the annual cost of a loan to a borrower and is expressed as a percentage

· APR is the annual cost of a loan to a borrower — including fees. Like an interest rate, the APR is expressed as a percentage. Unlike an interest rate, however, it includes other charges or fees such as mortgage insurance, most closing costs, discount points and loan origination fees.

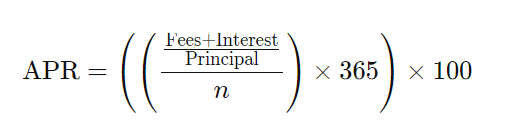

How Is APR Calculated?

The rate is calculated by multiplying the periodic interest rate by the number of periods in a year in which the periodic rate is applied. It does not indicate how many times the rate is applied to the balance.

Interest=Total interest paid over life of the loan

Principal=Loan amount

n=Number of days in loan term

AAA Lendings is a direct mortgage lender with over 20 years of lending experience. We have a group of experienced professionals providing services for home buyers and people with mortgage needs. We offer 100+ customized loan programs in conventional, FHA, VA, EZ qualified and foreigner nationalloans. We always put customer's needs first and provide the best customized solution for each customer.

Mortgage lenders in California,best mortgage lenders for first-time buyers,Best Mortgage companies to work for in California, Non-QM mortgage loans to borrowers in California,non-QM loans lenders, best Jumbo loans lenders, Jumbo mortgage loans lenders, Best Mortgage Refinance Lenders aaalendings

阅读原文 阅读 2323