If you are a foreigner and you want to own your own house in the United States, it will be difficult for you to get a housing mortgage due to the limitation of your identity. The mortgage bank would always expect you to provide a variety of different Docs to prove that your income and assets can support your mortgage.

But luckily, when you turn to a senior mortgage lender for help, they would be happy to help you solve your current troubles — to get the best mortgage based on your situation. With the priority of acquiring a mortgage for you, our Agents are willing to help you find the best mortgage plan.

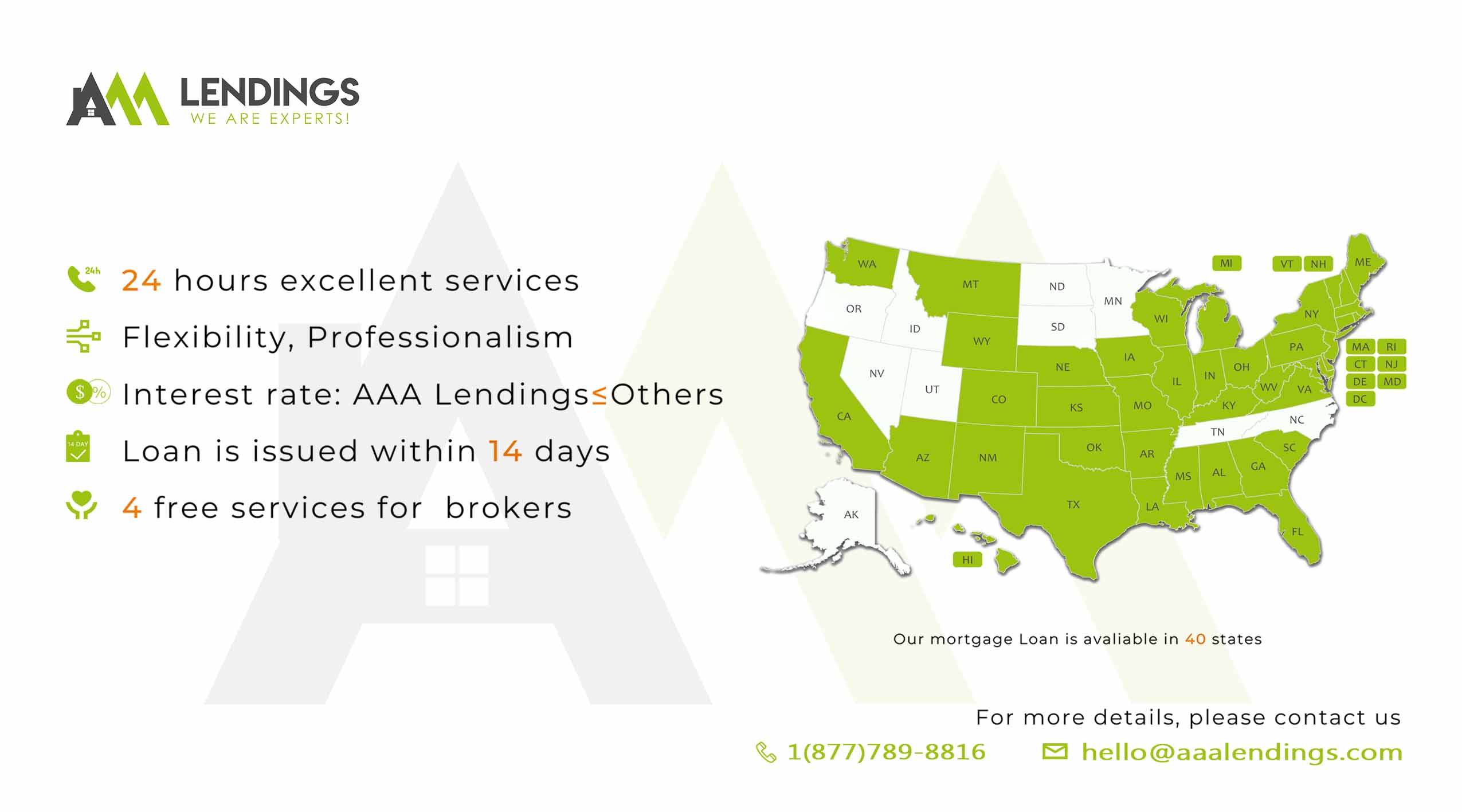

Here I'd like to recommend our company to you: AAA LENDINGS, established in 2002, is a well-established mortgage lender in Southern California. Over the years, we have maintained our leading position in Asian American community with professional and high-quality services. We are adept at providing solutions to the toughest cases, at the same time, we can provide competitive interest rate and reduce the overall costs for our customers.

In addition, we have a team of experts who can help you determine your credit score quickly and easily.

What are our selected home mortgage programs for you?

The answer is to choose Non-QM Mortgage as your option. Here are three options you can choose from.

The first one is the DSCR program

What is the DSCR program?

In simple terms, DSCR (Debt-Service Coverage Ratio) is a measure of the cash flow available to pay current debt obligations. It's the ratio of the monthly rent of an investment house with the total value of the housing expenses such as principal, interest, land tax, insurance and management fees.

The higher the ratio, the more you can prove that this investment house can bring you a considerable income return.

There are some pros and cons.

Pros

1. You are not required to prepare income documentation from the bank.

2. Gifts are acceptable.

With a closing time of 7-21 days, we don't need to go through a complicated and tedious review process, saving your time and providing you with convenience at the same time.

Cons

1. This mortgage program is limited to the purchase of investment-type properties and cannot be used for self-occupation.

2. A 30% down payment is required.

The second one is the WVOE program

What's the WVOE program?

Simply put, the WVOE (Written Verification of Employment) program requires the borrower's current employer to fill out an income verification document for the borrower. We will confirm the borrower's salary and income based on the information and details filled out by the employer to prove whether the borrower meets the loan requirements and can afford the loan.

What are the requirements for the WVOE program? Are you qualified for the WVOE program?

Pros and Cons are as follows.

Pros

1. Loan can be closed within 14-30 days.

2. Pay stubs or W2 are not needed.

3. Gifts are acceptable.

Cons

1. The WVOE program is only available to those who have jobs.

2. A 30% down payment is required.

The third one is the P&L program

What’s the P&L program?

If you are self-employed, i.e. you are your own boss, then congratulations, you are suitable for the P&L (Profit and Loss Statement) program.

The P&L program requires you to provide a profit and loss statement of your corporation to prove that your real income can offset your monthly repayments after applying the loan.

The requirements for the P&L program are very clear:

1. P&L program is only suitable for self-employed employers.

2. A 30% down payment is needed.

3. P&L statements and CPA (Certified Public Accountant) letters are required

Here are also some advantages:

1. You do not need to provide tax returns or 4506C statements.

2. Gifts are acceptable.

If you want to know more details, please contact us, our professional Agents will provide you with a one-stop butler service to help you solve your problems encountered in applying the loan.

STATEMENT:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

![]() The advantages of WVOE and P&L——AAA Lendings

The advantages of WVOE and P&L——AAA Lendings

阅读原文 阅读 1854