"I know you think you understand what you thought I said but I'm not sure you realize that what you heard is not what I meant."-- Alan Greenspan

At one time, Federal Reserve Chairman Alan Greenspan made the interpretation of monetary policy into a guessing game.

Every slightest move of this economic czar has become the global economic barometer of that era.

However, the outbreak of the Subprime mortgage crisis not only hit the U.S. economy, but also let the market feel very dissatisfied with the Fed’s guessing game.

As a result, the new Federal Reserve Chairman Berknan learned from these mistakes and gradually began to adopt the "expectation management" approach and continue to improve.

At present, as for this set of expectation management techniques, the Fed has almost played perfectly.

On Wednesday, the Fed announced its latest interest rate resolution, announcing a 50-basis point rate hike, and it will begin reducing its balance sheet in June.

For the Fed's such a strong tightening policy, the market's response seems to be very optimistic, with a sense that the market is factored into bad news.

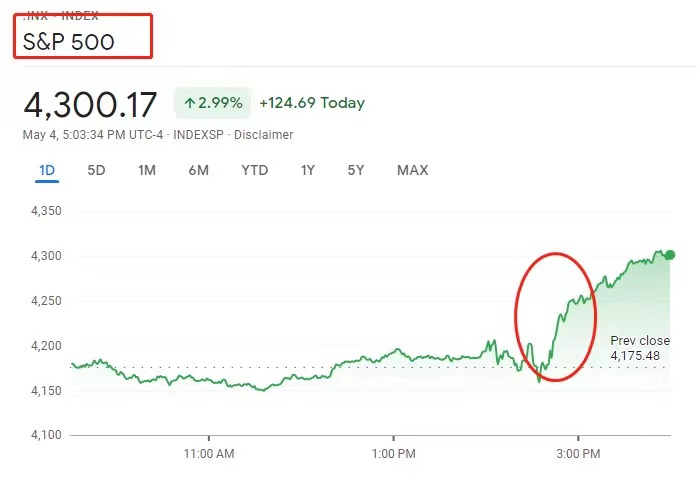

The S&P 500 hit the largest single-day percentage gain in nearly a year, and the 10-year U.S. bond also fell back after hitting 3%, once down to 2.91%.

According to common sense, the Fed announced a rate hike, which was monetary tightening, the stock market would have a certain decline, and it is logical that the U.S. bonds should also rise in response. However, why is there a reaction that is contrary to the expectation?

This is because the market has been fully priced in the Fed's actions (Price-in) and made an early response. All thanks to the Fed's expectation management - they hold monthly interest rate meetings before the rate hike. Before the meeting, they communicate repeatedly and frequently with the market to convey economic expectations, leading the market to accept the changes in the monetary policy.

In fact, as early as the end of last year, after Fed Chairman Powell was reappointed, he changed his previous doveish style and became aggressive.

Under the Fed's "expectation management", the market's expectations changed from whether there would be a contraction to whether there would be a rate hike, and increased from 25 basis points to 50 basis points. Under the influence of frequent hawkishness, the hate hike finally even evolved to 75 basis points. At last, the Fed’s "doveish parties " raised rates by 50 basis points.

Compared with the previous 25 basis points, 50 basis points plus the upcoming plan of shrinking the table are undoubtedly very aggressive. Finally, the result became "within expectations" because the Fed had made an expectation of 75 basis points.

In addition, Powell's speech also ruled out the possibility of more interest rate hikes, driving a significant improvement in market sentiment and easing worries about excessive tightening.

Through such a continuous early release of "hawkish signals", the Federal Reserve conducts expectation management, which not only speeds up the tightening cycle, but also calms the market, so that the effect of “Boots landing” would finally appear, thus it would spend the policy transition period cleverly and steadily.

Understanding the Fed's art of expectation management, we do not have to panic too much when the rate hike lands. It should be known that the most threatening things won’t happen before the rate falls from the highest point. The market may have already digested the "expectations" and even cashed in the impact of the rate hike ahead of time.

No matter how perfect the expectations are, it cannot obscure the fact that the Fed is still on the path of radical monetary tightening policy; that is, whether the treasury rates or mortgage rates rise, it is difficult to see an inflection point in the short term.

A key message is that the April inflation data will be released next week; if the inflation data falls back, the Fed may slow down the pace of interest rate hikes.

In the coming months, the Fed will probably repeat the same tactics, allowing the market to digest in advance through the expectation management. We have to lock the current lower interest rates as soon as possible; just as an old saying goes, a bird in the hand is worth two birds in the bush.

The above can be summed up with a sentence in the trading industry: Buy the rumor, sell the news.

Articles & Video Sharing:

![]() [Looking back at history] What has happened to the high oil prices that once occurred?

[Looking back at history] What has happened to the high oil prices that once occurred?

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1744