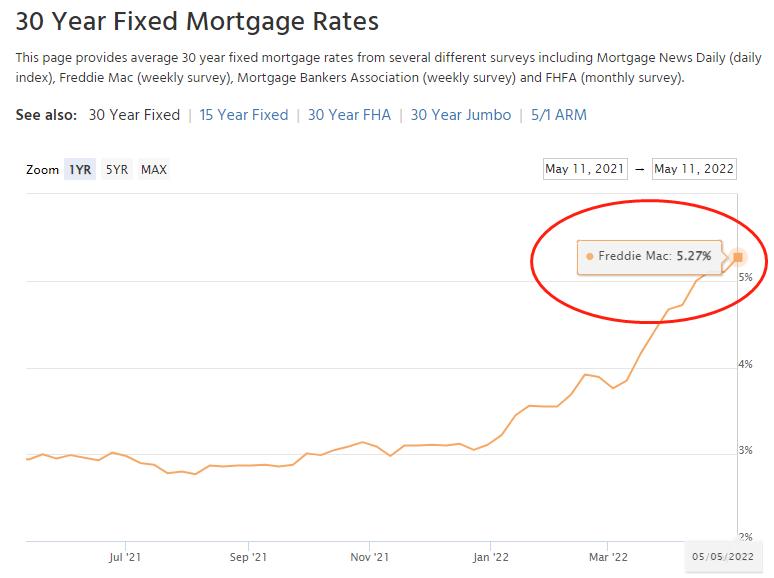

Freddie Mac shows that on May 5th, the average rate on a 30-year mortgage rose to 5.27%, a figure that was only 3% last August.

The last time when mortgage rates rose so much was in 1994. In late 1993, mortgage rates were less than 7%.

But the situation then was very similar to this year, with a series of interest rate hikes adopted by the Federal Reserve to save inflation; rates then soared to 9.11% in December 1994, a jump of more than two percentage points in less than 12 months.

Some professionals say mortgage rates could rise even more sharply in 2022 than in 1994.

Both in 1994 and 2022, the Federal Reserve has used the rate hike to fight inflation. Today, we will review together the impact of the 1994 mortgage rate spike on the real estate market and discuss the possible consequences of this increase.

Why did mortgage rates spike in 1994?

The U.S. economy fell into recession in 1990 and 1991, and it began a gradual recovery until 1994.

As the economy gradually got better, the Federal Reserve moved quickly to prepare to raise interest rates. At the beginning of 1994, the federal funds rate was 3%, and that number had risen to 6% by the end of the year.

The Fed's rate hike caught some market participants off guard. This also led directly to a series of market fluctuations in 1994. The bond market collapsed, leading to bankruptcies in several areas, including Orange County, California.

Mortgage rates then fell slightly in 1995, dropping to 6.95% in early 1996. For the rest of the 1990s, rates fluctuated between 6% and 9%.

Although economic conditions are different today, 30 years later, there are some similarities to 1994. For example, the Federal Reserve is curbing inflation by raising interest rates, etc.

How did the 1994 interest rate spike affect the real estate market?

The rise in interest rates did not bring about a slowdown in the housing market, and house prices continued to rise throughout the year 1994 when interest rates spiked.

According to the National Association of Realtors, the median home price in the U.S. was $107,200 in 1993 and climbed to $111,200 in 1994, and further to $114,600 in 1995.

House prices have often changed during other periods of rising interest rates.

Economists say that house prices tend not to decrease because sellers are mostly reluctant to lower their prices, but choose to stop selling for the time being.

Meanwhile, housing demand remained strong in the market at the time. A large amount of immediate demand prompted home sales to rise rather than fall.

At that time, home sales increased from 3.7 million in 1993 to 3.9 million in 1994, and then finally fell to 3.8 million in 1995 as homebuyers gradually adjusted to the new rates.

By 1996, home sales were well over 4 million, even though house prices had increased 8.29% by then, according to the data from realtors.

How will the interest rate spike of 2022 affect the housing market now?

The real estate market in the U.S. is very different today than 30 years ago. Nowadays, homebuyers are facing not only strong immediate demand from the Millennials, but also a severe shortage of homes for sale.

According to a recent Zillow survey in March, experts predict that it will take until 2024 for housing inventory to return to normal levels before the Covid-19.

At present, homeowners have unprecedented equity in their homes and are unlikely to experience a massive home loan default.

In fact, this is true for every generation - baby boomers didn't stop buying homes when mortgage rates soared into double digits in the 1980s.

Although rising mortgage rates may raise house prices, the surge in the U.S. millennial population in their 30s and 40s is still a strong driver of the demand for homes.

Bee's Wood forecasts that Americans will continue to purchase homes this year. The current North Canadian market, where some buyers are starting to wait and see, is causing the market development to slow down. However, there are still a large number of buyers watching the market closely, and the number of listings on the market is still far less than the buyer’s demand.

Higher interest rates have slowed the market down from all the data, but it is still far from reversing the “seller’s market”.

For friends who want to change homes recently, in addition to making financial preparations in the early stage and finding out the pricing and bidding strategies of buyers and sellers in the current market, it is also necessary to understand what methods can save money and worry about the two aspects of buying and lending a home.

In addition to making financial preparations in the early stage, to find out the pricing and bidding strategies of buyers and sellers in the current market, it is also necessary to understand what methods can save money and worry about buying a house and getting a loan.

Articles Sharing:

![]() Housing Market’s Big Selling Points: Who is Purchasing? Who is selling?

Housing Market’s Big Selling Points: Who is Purchasing? Who is selling?

![]() Adjustable-rate Mortgages Are Becoming More and More Popular Nowadays

Adjustable-rate Mortgages Are Becoming More and More Popular Nowadays

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 2033