Under the Fed's continued aggressive "tapering", digital currencies are experiencing a "cold winter," and fleeing risky assets has become the main plot of this week; History is always strikingly similar, as last year's 519 cryptocurrency panic crash is still fresh in our minds, with over 430,000 people blowing their positions. The fishy storm is on again.

According to CoinMarketCap, the entire cryptocurrency market lost more than $500 billion in value last week alone. Since last November, more than $1 trillion in digital currency market capitalization has come to naught. The market was even more shaken by the "death stampede" of UST, the third-largest stable coin in the cryptocurrency market, and its sister token Luna.

Many analysts pointed out that investors are fleeing from risky assets under the multiple pressures of high inflation and the Fed's aggressive "water collection" or economic stall, and that a "crypto winter" is coming.

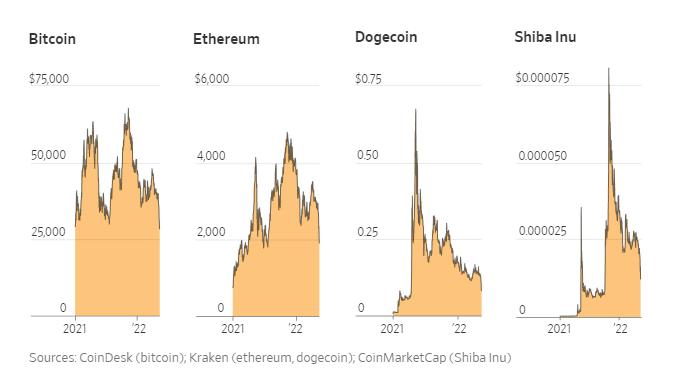

On Friday, bitcoin finally climbed back above $30,000 from its lowest point since December 2020 after seven straight days of losses. A host of cryptocurrencies also recovered from a full market rout as investors ramped up. According to the data from CoinMarketCap, bitcoin, the largest cryptocurrency by market capitalization, climbed 9.3% on the day; Ethereum, the second-largest cryptocurrency, rose about 9% to trade at $2,065 after falling more than 20% in the last week; and other cryptocurrencies such as Cardano and Solana also jumped 28% and 20%, respectively. Meanwhile, dogecoin rose 18%.

Although cryptocurrencies rebounded on Friday, they are still well below the all-time highs set last November compared to bitcoin's $45,000 trading level before the Russia-Ukraine conflict. Moreover, this week marks its seventh consecutive week of losses and the longest weekly loss period in its history. Before this year, Bitcoin had not seen such a long streak of weekly losses.

Last year, cryptocurrencies caught fire. After years of being considered a speculative fringe product, cryptocurrencies that gained more legitimacy and investor favor saw a spring in their step. Tesla Inc. said it bought $1.5 billion of bitcoin, driving the price up; Coinbase went public last year as the "number one crypto exchange,"; While the MicroStrategy, the world's largest public company in bitcoin, firmly believes that bitcoin is "the most desirable property in space and time".

In November, two major cryptocurrencies, Bitcoin and Ethereum, reached all-time highs. Bitcoin was worth $67,802.30 at 5 p.m. on Nov. 9; Ethereum was worth $4,800. Now, they are down 58% and 60% from their highest time, respectively.

Susannah Streeter, a senior investment and market analyst at Hargreaves Lansdown, warned that some traders might see this month's sharp drop as an opportunity to buy the decline. Still, given its huge volatility, cryptocurrencies may fall further. The latest plunge in the Wheel of Wealth shows that speculating in cryptocurrencies is extremely risky and unsuitable for investors who don't have the money to withstand losses.

Stable coin TerraUSD (or "UST," an algorithmic stable coin designed to maintain a one-to-one peg to the U.S. dollar) collapsed a few days ago after decoupling from the U.S. dollar, and the last trading price is $0.15; Same like its sister coin, Luna, which had plunged to zero by Friday from more than $80 a week ago. As a result, Yellen renewed her call for Congress to authorize the so-called stable coins regulation at the Senate Banking Committee hearing on Tuesday.

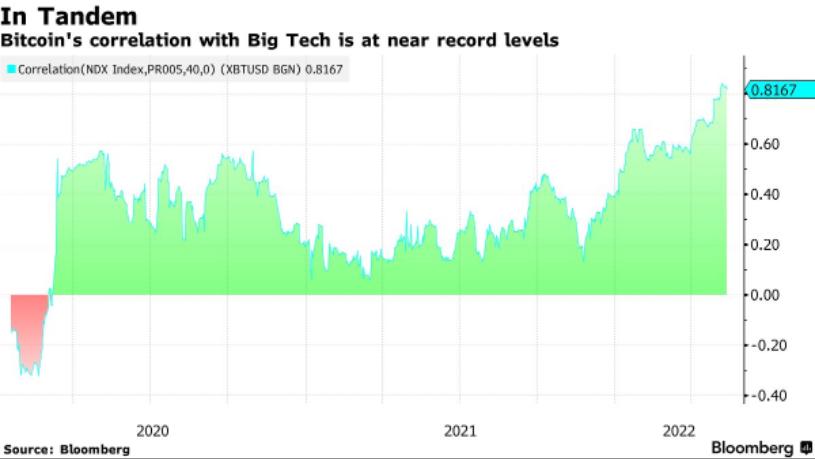

Cryptocurrencies also face other challenges, especially their increasing proximity to the trading trends of tech stocks. According to the data compiled by Bloomberg, the 40-day correlation between bitcoin and the Nasdaq 100 is currently at 0.82, close to a record value (a correlation of 1 means the two assets are trading in perfect alignment; a reading of -1 means they are trading in opposite directions).

Adding insult to injury, cryptocurrency trading, originally a game for individual investors, is now dominated by institutional investors such as hedge funds. But as prices have moved lower, both individual and institutional investors have backed off. Coinbase revealed it was losing users when it reported its first-quarter results on late Tuesday, and by the end of trading on Thursday, Coinbase's stock was 82% lower than its closing price on its first day of trading last year.

Articles Sharing:

![]() What has happened to the housing market since 1994, as mortgage rates also soared?

What has happened to the housing market since 1994, as mortgage rates also soared?

![]() Bubble Or No Bubble? History Tells Us How Likely A Real Estate Crash Is This Year

Bubble Or No Bubble? History Tells Us How Likely A Real Estate Crash Is This Year

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 2501