Since January 2022, mortgage rates have climbed to a near 3-year high, along with increasing inflation and two significant interest rate hikes by the Federal Reserve. As of May 5, the average 30-year mortgage rate has risen to 5.27%, and the 15-year is 4.52%.

(Source: Freddie Mac)

Has the market relationship between supply and demand in the housing market reversed in such an economic climate? Let’s analyze the latest market dynamics today.

Housing Inventory is up, but demand still outstrips supply

In mid-April, the National Association of Realtors released its latest “Realtor Confidence Index”.

Fifty thousand front-line Realtors from all 50 states were interviewed to provide first-hand data on recent real estate transactions around the country, and the latest data shows:

On the supply side of the housing equation, there were 950,000 homes for sale across the U.S. in March 2022, up 11% from February, but still 9.5% lower than the same month last year.

The current average inventory (MOI: Months of Inventory) on the market across the U.S. is only two months, meaning that if no more new listings started to come on the market now, all the listings on the market would be sold out within two months.

Theoretically, to reach a perfect state of complete supply and demand balance, the market inventory should be six months.

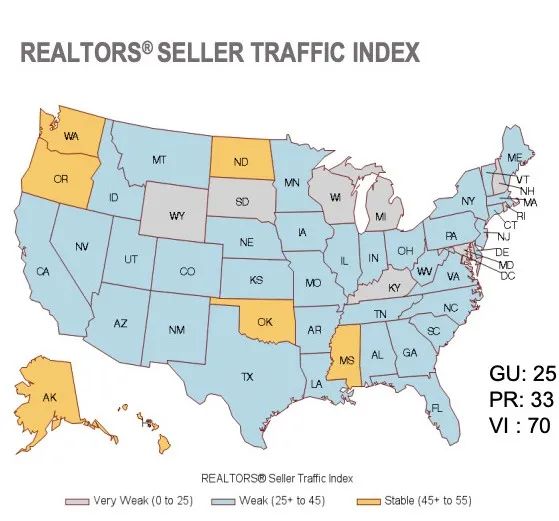

As shown in the chart below, states in blue indicate a weak flow of sellers entering the market to sell their homes, states in yellow are a stable flow of sellers, and gray means the flow of sellers is very weak.

(Source: NAR Realtor Confidence Index Survey – Seller Traffic Index)

The current low number of sellers may be that the perception of higher mortgage rates has reduced buyers’ enthusiasm and that homes cannot sell for good prices at this time of year, so they are not ready to sell these days.

There are also some sellers waiting for the arrival of the summer seller season.

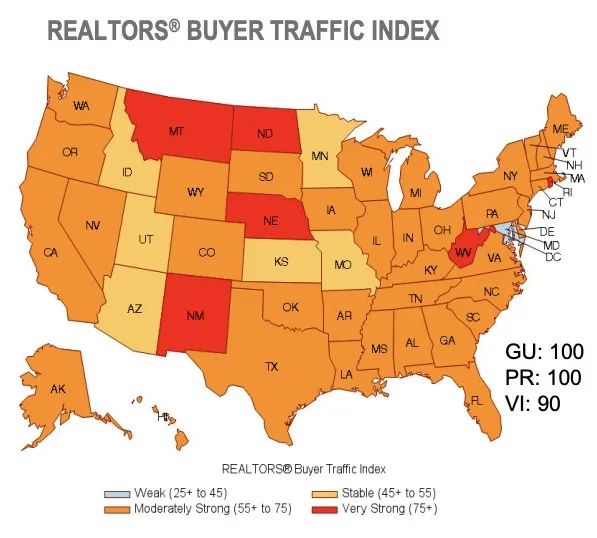

Looking at the demand side, brokers are still very optimistic about buyers entering the market; as seen in the chart below, buyers are still active in most states across the U.S. (states in orange and red in the following chart).

(Source: NAR Realtor Confidence Index Survey — Buyer Flow Index)

According to brokers, there will still be fierce competition to buy a home soon, with an average of about 4.8 offers received per listing for sale, a figure that was also 4.8 during the same period last year when the housing market was hot.

87% of listings were sold within a month, compared to 83% a year ago. 57% of buyers made a price increase in buying a home, compared to 48% a year ago.

Listings stayed on the market for 17 days, compared to 18 days a year ago.

The increase in mortgage rates has led some buyers to wait and see, but the relationship between supply and demand dictates that the housing market remains a "seller’s market”.

In addition, the global shortage of building materials and the lack of labor in the U.S. construction industry have not been alleviated in new home construction. The waiting time for new home permits is still very long. Therefore, the housing supply from new home builders is still very limited.

To sum up, the oversupply in the housing market has not been reversed, but only somewhat alleviated.

Will home prices plunge sharply in 2022?

Throughout history, housing market crashes have only occurred in markets with a high surplus of housing stock and little interest on the demand side.

For example, the housing crisis was triggered by the subprime mortgage crisis from 2008 to 2010. At that time, many people with low credit scores and poor incomes bought homes with zero down payments. When the recession and unemployment hit, they could not afford the monthly payments, and the banks repossessed their homes.

But in 2022, there are still a limited number of homes on the market. Buyers who haven’t bought a house yet aren't leaving, and new buyers are still entering the market just more cautiously.

In addition, with the previous experience of 2008, home lenders have been very strict about lender qualifications in recent years, which has greatly reduced the risk of lenders breaking their mortgage payments, so there won't be a large number of foreclosed properties flowing onto the market now.

Because of the soaring home prices over the past few years, homeowners have unprecedentedly high equity in their homes, and can immediately sell their homes at a good price if their family finances are in trouble; therefore, on the sellers’ side, there is no reason to sell their homes at a low price.

In the highly competitive North Canadian market, the current inventory of homes is still very low. The overall housing inventory is only about 1.4 months old.

As long as the market conditions of less supply than demand persist, home prices will continue to rise, but the increase rate will likely slow.

Is the year 2022 still a good time to buy a home?

There is no best time to buy a home, but only the right time.

If you are an investment homebuyer, you need to evaluate the cash flow constantly, the return on equity, the promotion potential, and the investment cycle of the property.

If you are a new home buyer, you may also need to take another look at your financial situation at:

1. Your current debt situation.

2. You are ready for a 5%-20% down payment, and you also need to know that a lower down payment means an extra premium.

3. You have prepared a closing cost of approximately 1-3% of the total housing price.

4. You have an emergency fund equal to at least three months of household income.

5. Choose the most appropriate interest rate for your loans, such as a more favorable 5/1 or 7/1 ARM loan, etc

If you have all these things in place, then your pace of looking at and choosing a home should not be disrupted, and you should choose the right time to buy a house according to your actual situation.

With such fierce competition today, a mortgage should not be a stumbling block on the road to buying a house when you finally come across the house you want.

By choosing AAA LENDINGS, we can help you get a loan within 20 days and offer you the most efficient and fast loan experience.

Articles Sharing:

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1597