10-year U.S. Treasury Retreated

In the earlier years, as the Federal Reserve went further and further down the hawkish path, the 10-year U.S. bond yield also continued its upward march, soaring from 1.5% at the beginning of the year all the way to 3.2% on May 9.

Last week, however, there was a respite for treasuries after a heavy sell-off, and yields have fallen sharply from this year’s highs, now down to 2.743%.

Correspondingly, there was a fall in U.S. stocks, a fall in the probability of an expected interest rate hike, and a rise in gold.

Behind the decline in yields with U.S. bonds, the substance reflects the market is gradually shifting from inflationary concerns to recessionary concerns.

The market expects the Fed fund's monetary tightening policy to be forced to a halt by recession expectations; the so-called Fed put option (Fed Put).

Currently, the Fed has taken a series of tightening actions to curb inflation, but monetary policy, as a blunt tool, is difficult to precisely reach the ideal state where inflation falls right back to the target range and the economy is not affected.

Recession fears have risen as a turning point for Treasury rates, and recession has turned from an "unlikely event" to the increasingly serious risk.

In addition, several Wall Street banks have issued a warning on the U.S. economic outlook, while the Federal Reserve is trying to balance inflation and recession risk.

Does the Fed hint at the end of the rate hike?

On Wednesday, the Fed's latest minutes from its Minutes of the May meeting were released, revealing heavyweight information that made the market begin to speculate that the Fed has heralded the end of the cycle of interest rate hikes.

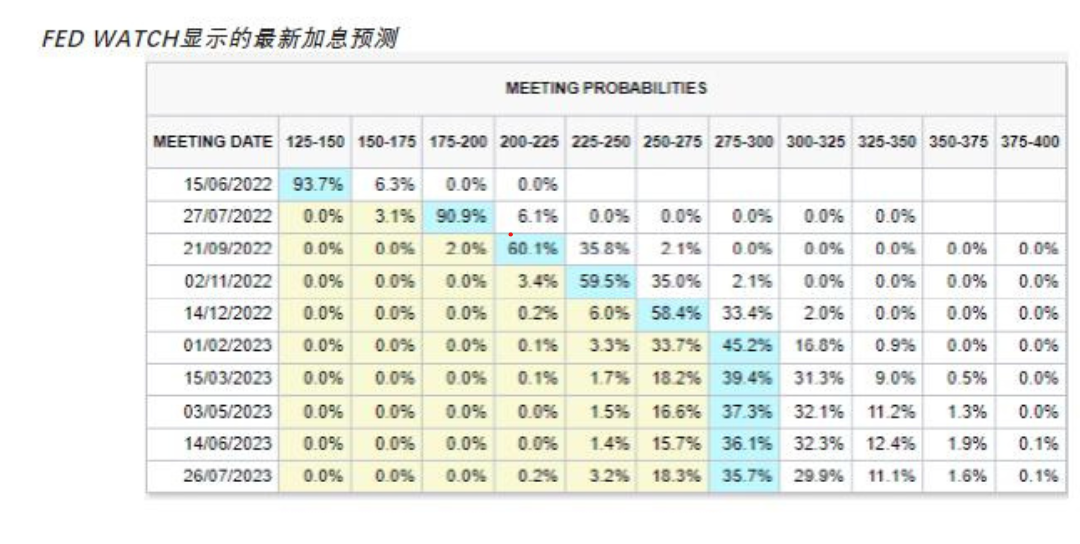

According to the minutes, there is almost no doubt that there will be a 50-basis point hike at each of the June and July rate meetings until September.

But a key adjustment caught the market’s attention. Compared with March, the Fed lowered its expectations for the next two years regarding the personal consumption expenditure price index (PCE), indicating that the Fed has gone through a process from rising to falling inflation expectations.

This adjustment should not be underestimated; Bloomberg strategist Vincent Cignarella pointed out that if PCE expectations are accurate, it means that with three more 50 basis point rate hikes, the Fed will end the current monetary tightening cycle.

In this way, it seems that September this year has become a key watershed in the Fed's monetary direction, but whether it will really suspend interest rate hikes or reduce the rate hikes depends on the inflation situation.

Mortgage rates stabilizing

Freddie Mac said in a statement Thursday that the average interest rate on 30-year loans fell to 5.10 percent from 5.25 percent last week, the biggest drop since April 2020, although rates are still well above the 3.11 percent they were at the end of last year.

Looking at the trend over the last month, the upward trend in mortgage rates has begun to slow.

Mike Fratantoni, the chief economist at the Mortgage Bankers Association (MBA), said,“Mortgage rates are likely to stabilize around current levels, and once we get past the cycle of spikes and volatility, MBA expects potential homebuyers may be more willing to re-enter the market.”

While economic uncertainty will still cause mortgage rates to fluctuate, the market’s adjustment to the Fed’s rate hike expectations is expected to be reflected in the stabilization of mortgage rates in the future.

Articles Sharing:

![]() The Real Estate Market Is Booming! Who Are the Losers? Who Are the Winners?

The Real Estate Market Is Booming! Who Are the Losers? Who Are the Winners?

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1670