Inflation throw cold water again! CPI Exceeds Expectations

Nearly two weeks ago, after the release of the lower-than-expected PCE (Personal Consumption Expenditures Price Index) price index in April, the market was well. It is believed that there are early signs of the inflation peak and people began to anticipate whether the next CPI data could be amazing, too.

However, before Friday, JP Morgan said that the upcoming CPI data would exceed market expectations. This report shattered the market’s illusions about cooling inflation.

U.S. stocks fell sharply on the news, and the 10-year Treasury yield continued to rise, breaking the 3% mark.

More surprisingly, the Labor Department said on Friday that the consumer price index rose by 8.6 percent in May from a year earlier, which even far more than the 8.3 percent which the market expected.

The higher-than-expected data completely shattered dreams that inflation could fall back by the middle of the year.

The stock market fell into the “Black Friday”, and the 10-year treasury yields jumped to 3.1%.

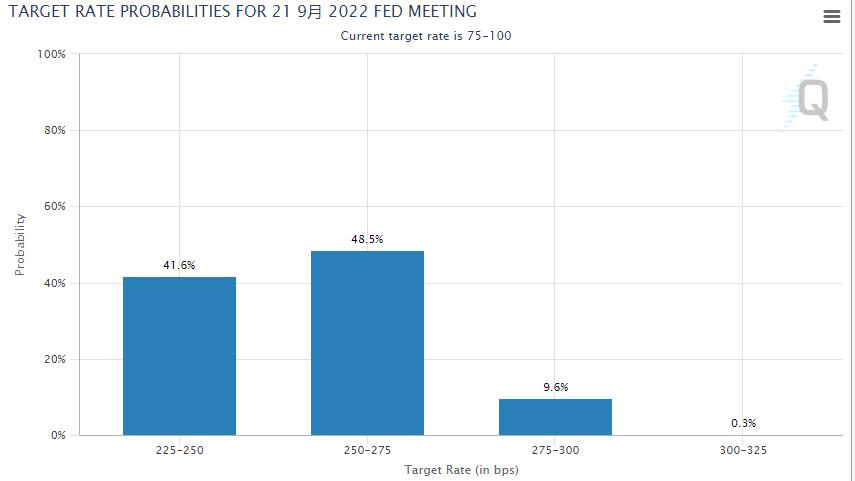

This month’s meeting on rate will be held on June 14, Fed officials said in the grand finale speech before entering the silent period that whether interest rates will continue to rise by 50 basis points in September will depend on the performance of the inflation data.

Chicagoland data showed a 41.6% probability of a sustained 50 basis point rate hike in September just after the release of the inflation data. However, there is even a 48.5 percent probability of a 75 basis point increase at one of the next three meetings.

The market has almost decided that despite the many measures taken by the Fed, inflationary pressures are becoming entrenched and even continuing to rise: more crazy rate hikes are coming.

Yet will this really be the case? Why is inflation so stubborn in the face of such tough tightening?

Hope is brewing slowly

A key inflation statistic is being overlooked by many people: Although monetary tightening policy has pushed rates higher, core CPI has fallen back for two consecutive months.

The core CPI is the consumer price index that excludes food and energy prices. It is a truer reflection of how the economy is performing since it excludes commodity prices that have temporarily risen for supply reasons.

The overall rise in the CPI is mainly led by the surge in energy and food prices, which is the main reason why the core CPI has diverged significantly from the inflation trend.

Turnaround may be coming

Since the beginning of this year, the Russian-Ukrainian conflict has led to a surge in energy and food prices; the supply of raw materials and intermediate goods needed for industrial production in the U.S. under the recurring epidemic in China is insufficient, and supply chain fluctuations have led to a rise in commodity prices.

However, war will never be the main tone, and the supply deficit caused by the epidemic is gradually recovering, and the long-term trend of prices will eventually return to the right track.

In addition, the Biden administration has recently begun to take a stand on reducing tariffs on China. Prices and inflation are precisely the important issues that will determine how voters will vote in the midterm elections, and the Biden administration, which is trying to effectively control inflation, will likely eliminate some, even all of the tariffs imposed on China.

The current high level of inflation is controlled not only by tightening monetary policy, but also by lowering tariff rates, which can largely reduce the living cost and thus suppress the inflationary trend. Some studies suggest that the elimination of additional tariffs will bring CPI growth down to around 3.4 percent.

This means that the Fed will thus gain more policy space, and the Fed will then also put on the tightening brakes when there is a clear inflation decline.

Overall, although inflation and rate hike expectations are not very optimistic, there is no need to be too pessimistic.

It is important to know that after the pessimism of the market being released, the worst moment may have passed.

Things always get worse before they get better.

Articles Sharing:

![]() https://www.aaalendings.com/news.asp?id=678&uname=

https://www.aaalendings.com/news.asp?id=678&uname=

![]() https://www.aaalendings.com/news.asp?id=679&uname=

https://www.aaalendings.com/news.asp?id=679&uname=

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1687