Dramatic changes in a short time

As the Federal Reserve tightens monetary policy to combat the worst inflation in 40 years, the U.S. economy is on the brink of recession.

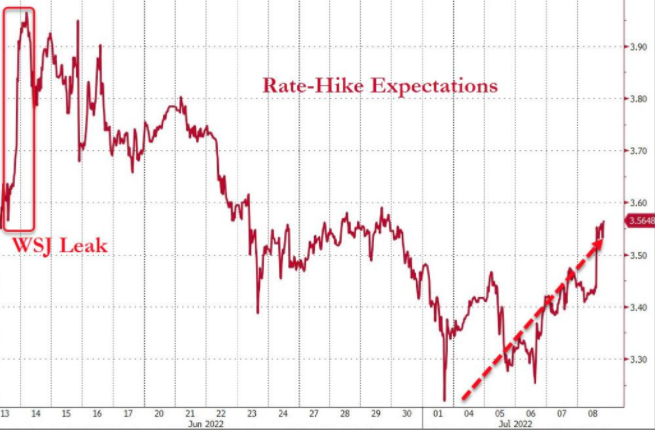

Investors have become far more fearful of recession than inflation in the last week.

Most major Wall Street banks have issued warnings of recession, and Wells Fargo even said that the United States has fallen into recession.

As the stock market accelerated its decline, the bond market moved higher collectively, and the dollar index hit a 20-year high, trading on expectations of the recession dominated.

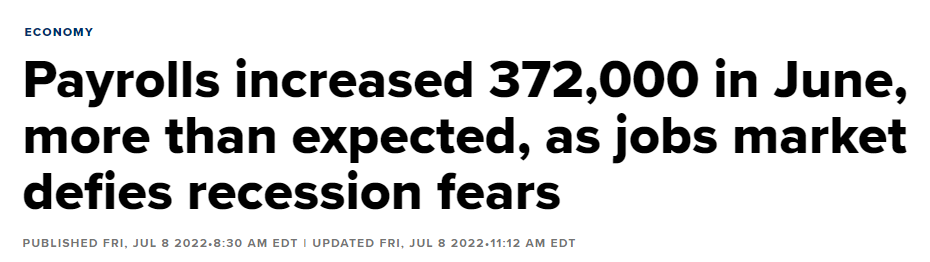

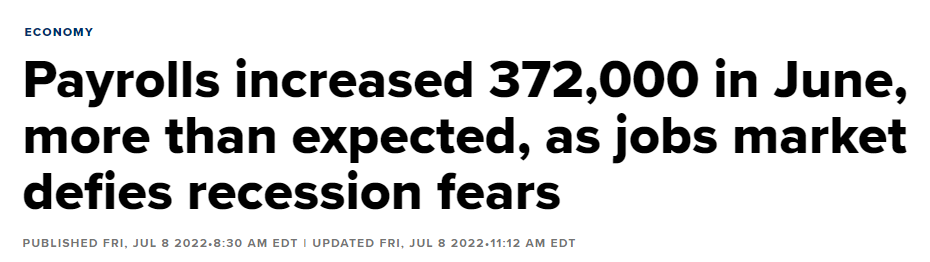

With the onset of the recession, businesses and the economy are facing increasing pressure; economists believe that the labor market is losing momentum, while the non-farm payrolls data on Friday could be a catalyst for market volatility.

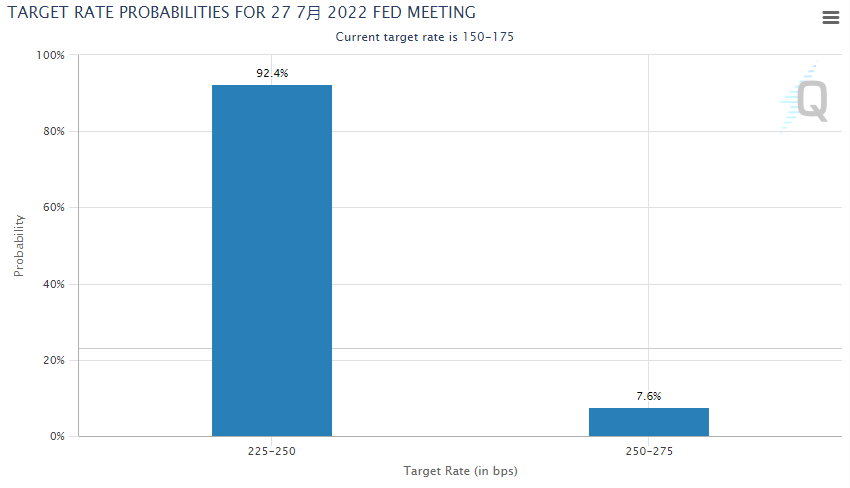

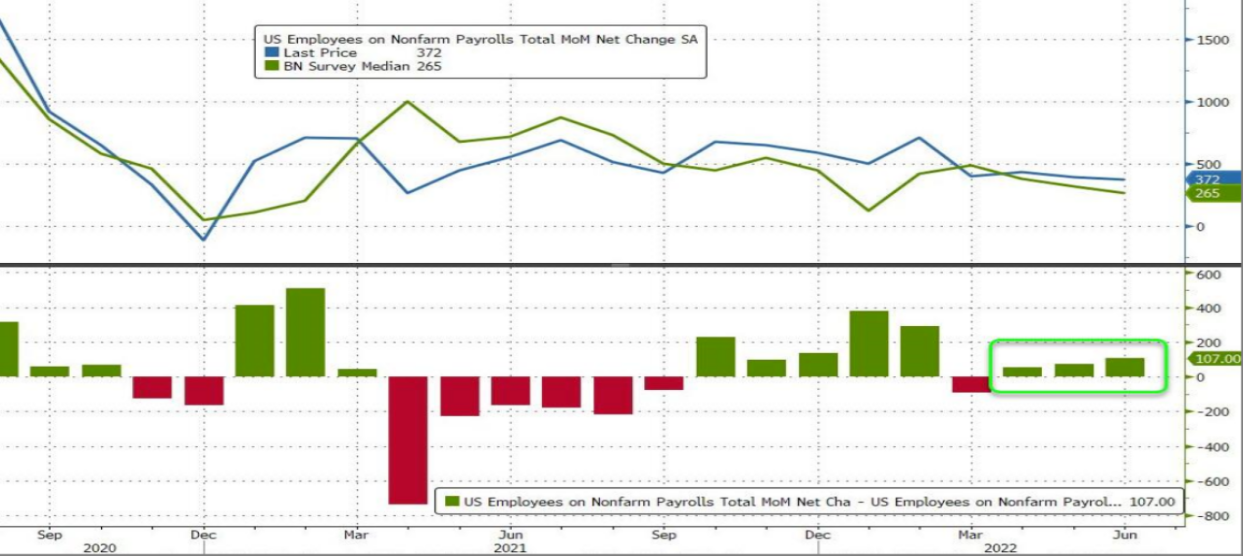

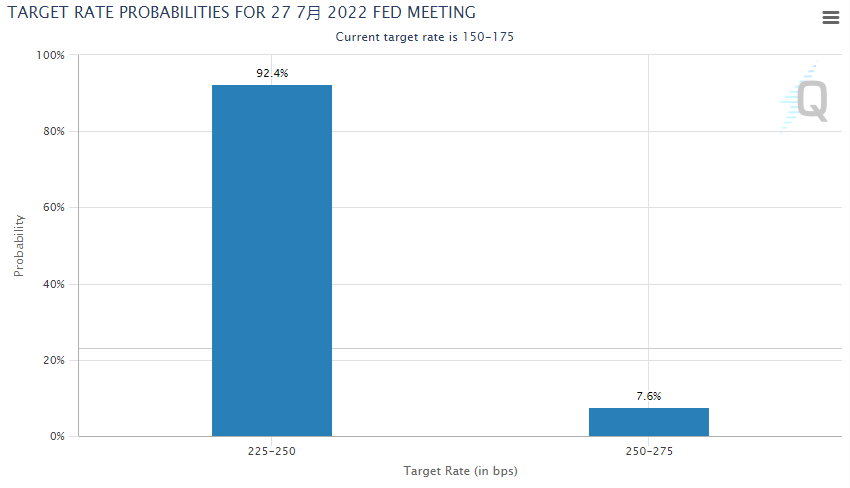

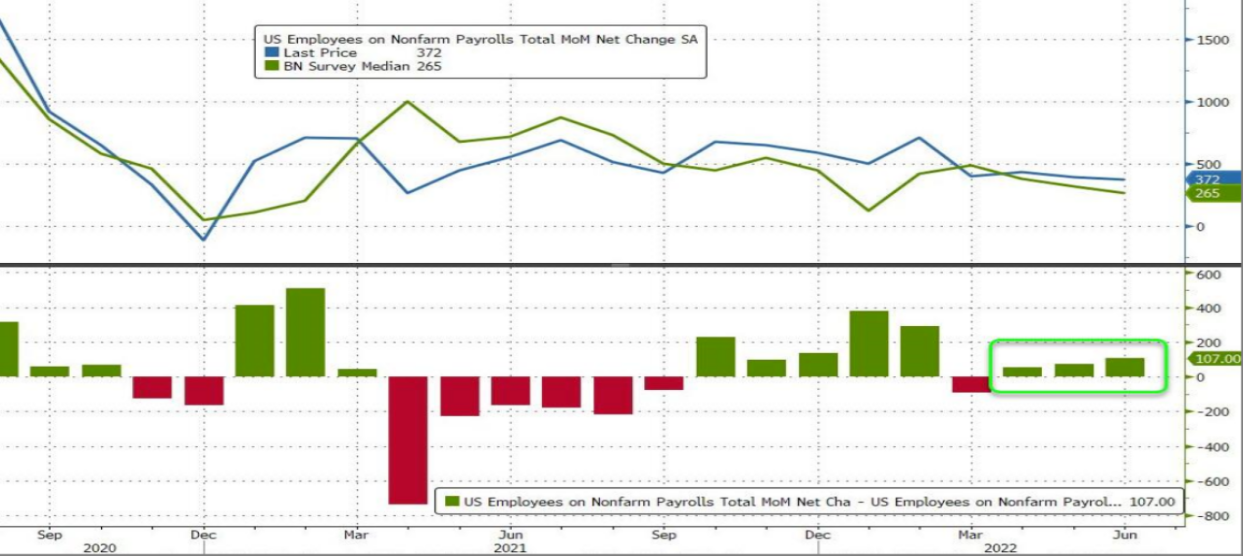

However, U.S. bond yields jumped back above 3% after Friday, and the probability of a 75 basis point rate hike in July soared to 92.4%.

All because that this data is far from being as weak as most people expected,

but turns out to be pretty good.

How to comprehend this report?

The Labor Department reported on Friday that 372,000 new jobs were created in June while the unemployment rate held at 3.6 percent, among the lowest rates ever.

So why did this report shift market conditions in a short time? How did it attract great attention from all parties?

We know that the dual mission of the Fed is to maintain price stability and ensure maximum employment, so the Fed’s policies have been trying to strike a balance between “inflation” and the “unemployment rate”.

However, with inflation now too high, the priority of Fed’s policy is to reduce inflation at the expense of jobs and growth to a certain extent.

Although the “unemployment rate” is a major concern of the Fed, it is a lagging economic indicator. It takes some time for the job market to embody the unemployment rate. Therefore, non-farm payrolls are considered as leading unemployment rate indicators and reflect how the economy is going to a certain extent.

As mentioned in the previous articles, the market is in a state where good ecodata nomic news equal bad ones. The non-farm data is beyond our expectation which indicates that the economy is not tipping back into recession as a result of fed tightening; however, the most direct consequence is that The Fed will be more reckless in raising interest rates.

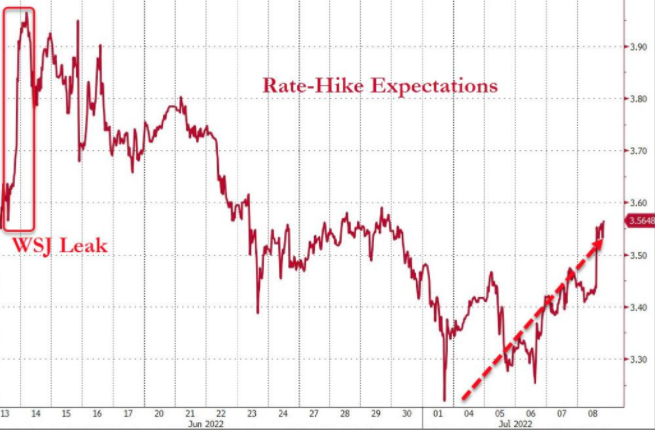

It is worth noting that there is a key figure between non-farm payrolls and the unemployment rate: when non-farm payrolls remain above 200,000, the labor market is considered very strong.

Non-farm payrolls have been above the 200,000 level since 2021, giving the Fed the courage to keep raising rates aggressively.

So when we look at this data in the next few months, anything above 200,000 leaves no doubt that the Fed will change its mind: the Fed thinks it can now ignore the Labour market and put all its attention on inflation.

The expectation of the recession may be "too early"

After the data released on non-farm payrolls, U.S. stocks and gold rose slightly, but the dollar fell slightly.

However, at this critical moment, there were tiny market fluctuations that weren’t consistent with such important data.

What is behind this is actually the game between the “recession fears recede" and “more hawkish Fed”, and the market is not as calm as it seems, but full of competition.

A 75 basis point rate hike this month (July 28) is cast on stone, and the strong job market has supported the Fed to step up austerity measures.

While previous trading of the market on recession expectations may be “premature”, it is clear that the non-farm payrolls data has temporarily calmed people’s fears of recession. Although the economy has shown signs of slowing, all talks about the recession is now premature and does not ease fears of further sharp rate hikes by the Fed.

Market bets on Fed rate hikes are starting to rise, with rate forecasts jumping above 3.6 percent in the first quarter of next year.

The previous economic recession may be a false alarm, but the Fed still needs to be sensitive to the economic slowdown and tighter financial environment.

Perhaps markets will stop being panic only when the FED starts being panic.

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1498