"Obviously, I see that all the houses in the neighborhood are dropping in price and have been listed for many days without selling, so why do I see the data that prices continue to hit new highs and listing times have shortened?"

Since the first half of the year, despite the continued decline in transactions in the real estate market, but the price is a record high, the reality of the real estate market seems to have been in a state of divergence from the data, many people wonder: in the end, who should believe in?

On August 18th, the latest real estate market report from the National Association of Realtors showed that the data have finally returned to reality.

Today we'll give you an analysis based on the latest U.S. housing market report for July from NAR.

Divergence between unsold home volumes and prices disappears

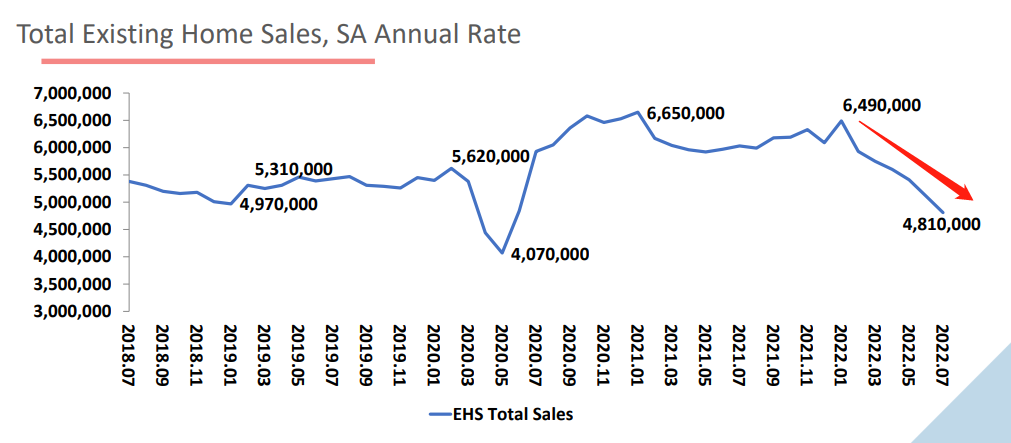

Number of homes sold (on an annual basis)

Source from National Association of Realtor

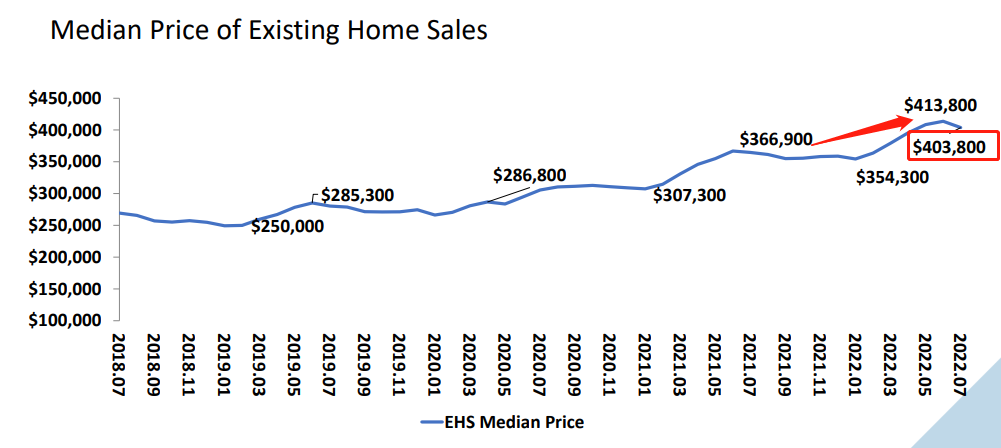

Median sales price of existing homes

Source from National Association of Realtor

It is clear from this comparison of data that the U.S. housing market has been in a state of shrinking volumes and rising prices during the first half of the year.

The interest rate hike policy initiated by the Federal Reserve at the beginning of the year seemed to immediately braked the housing market, but the corresponding median existing home price broke new highs, reaching as high as $416,000 in June - the highest existing home price since records began in 1954.

There are two reasons for this phenomenon: First, the fundamentals of the supply and demand structure have not changed, and the housing market has been in a state of unbalanced supply and demand due to a shortage of housing units.

The second reason is the time lag of the data, i.e. the impact of the increase in mortgage rates due to the interest rate hike has not yet been fully reflected in the data.

The median price of an existing home fell to $403,800 in July, the first decline since the first half of the year, indicating that the falling price phenomenon no longer exists - housing inventory is gradually increasing, and the erosion of homebuyer affordability due to rising interest rates is beginning to show up in the data.

Real estate investment is still in demand

In the July report on the housing market, we noted

an interesting phenomenon.

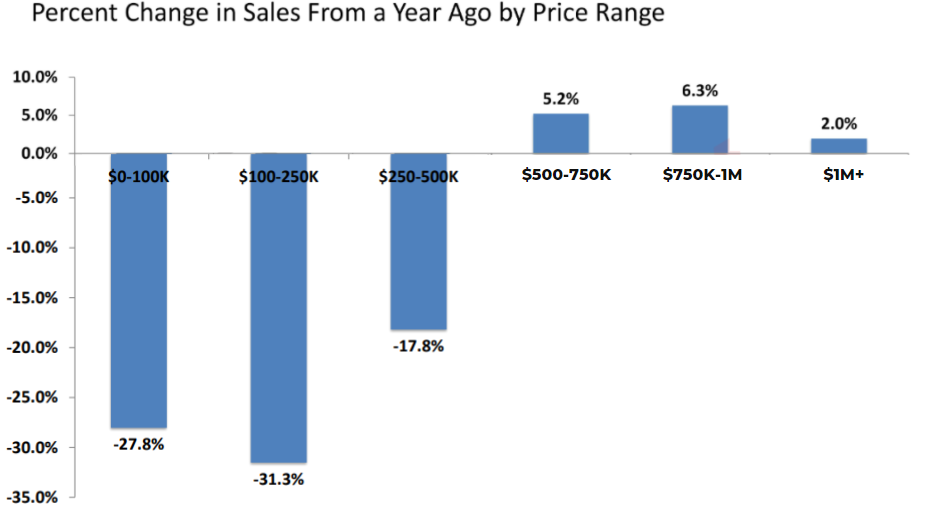

Year-on-year change in sales of houses in various price categories

Source from National Association of Realtor

As can be seen from the year-over-year changes in home sales in various price ranges, the number of homes sold in the U.S. under $500,000 decreased significantly, while sales of homes over $500,000 increased by 2% to 6.3% compared to the same period last year.

This data shows very directly that the number of real estate investors is growing.

This is because real estate prices have regained value. When interest rates are low, it is relatively fair for everyone and everyone can fulfill the dream of home ownership, but when interest rates are high, those who cannot afford higher monthly payments and down payments lose out.

Because of polarization, cash-rich buyers hold the market power, buying more and more and more expensive homes, while the cheaper homes that the general public can afford remain stagnant in the high-interest rate environment.

For this

reason, the median price of homes for sale increased in the first half of the

year, despite rising interest rates.

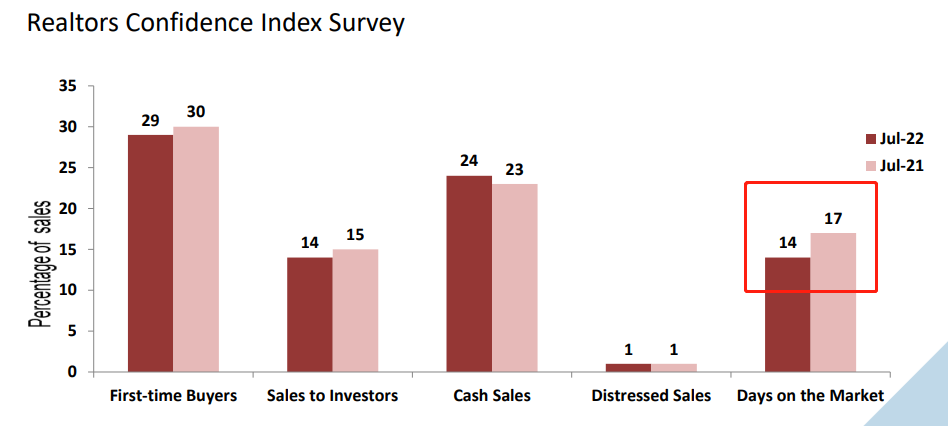

Realtors

Confidence Index Survey

Source from National Association of Realtor

Another phenomenon: the listing period has become even shorter! As you know, last year was the hottest year for the real estate market, and the offer period was only 17 days in July, while the current figure is 14 days.

When cost-effective properties appear in an already undersupplied market, the battle for investors is speed, and established investors are heavily involved in buying and selling properties, so offer times are shortening.

Enthusiasm from foreign investors bucks the trend

As the U.S. real estate market begins to cool,

foreign buyers are bucking the trend of enthusiasm.

The report shows that the total value of residential real estate purchased by foreigners in the U.S. reached $59 billion from April 2021 to March 2022, up 8.5 percent from a year earlier and breaking a three-year trend of decline.

For foreign homebuyers, the market is pretty good now, after all, there are fewer domestic buyers in the U.S. and less competition to buy a home, which is actually good for buyers who can afford it.

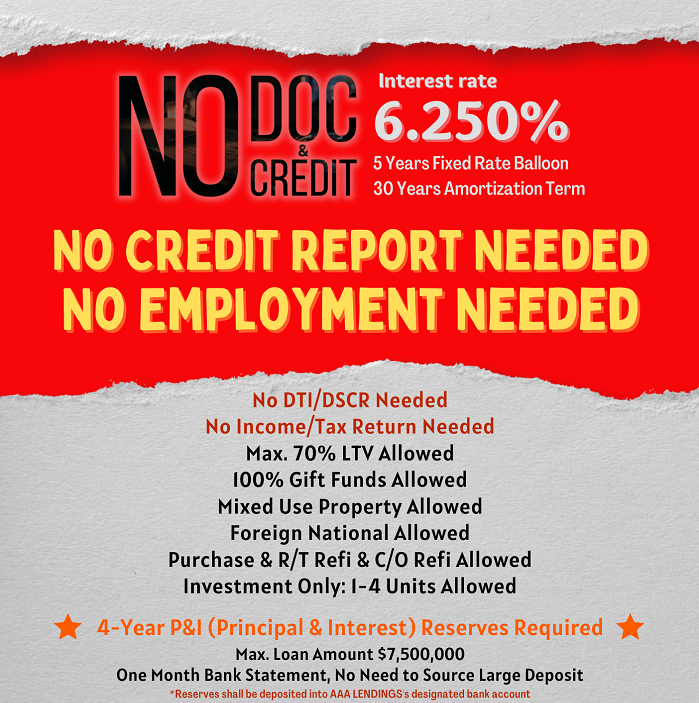

If you have already found the right investment property, do not miss out on the "No Doc, No Credit" program - the loan process has never been easier and free of any strings attached, helping you realize your investment dream faster!

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1385