What is the secret of this speech?

Jackson Hole annual meeting is known in the circles as the "annual meeting of global central bankers", is an annual meeting of the world's major central bankers to discuss monetary policy, but also traditionally the global monetary policy leaders reveal the important monetary policy "wind vane" of the future.

What are investors most concerned about at this

annual central bank meeting in Jackson Hole? Without a doubt, Powell's speech

is the top priority.

Federal Reserve Chairman Powell spoke on the topic of "monetary policy and

price stability", only 1300 words, less than 10 minutes of speech, the

words did cause the whole market triggered a huge wave.

This is Powell's first public speech since the FOMC meeting in late July, and

the core of his speech this time is actually two words - lower inflation.

We summarized the key contents as follows.

1. Inflation data for July unsurprisingly improved, inflation situation remains

tight, and Fed Reserve will not stop raising rates to restrictive levels

2. Lowering inflation may require maintaining tight monetary policy for some time, Powell does not agree that the market is pricing in a rate cut next year

3. Powell stressed that managing inflation expectations is critical and

reiterated that the pace of rate increases may slow at some point in the future

What is the "restrictive level?" This has already been stated by

senior Fed officials: the restrictive rate will be "well above 3%."

The current Federal Reserve policy rate is 2.25% to 2.5%. In other words, to

reach the level of the restrictive rate, the Fed will raise interest rates by

at least another 75 basis points.

All in all, Powell repeated in an unprecedentedly Hawkish style that "inflation does not stop, rate hikes do not stop" and warned that monetary policy should not be eased too soon.

Powell as hawkish, why are U.S. stocks fearful of a slump?

Powell spent only about eight minutes of his speech completely derailing

the mood of the U.S. stock markets since June.

In fact, Powell's words are not too different from his previous statements, but

just more resolute in attitude and a stronger tone.

So what has led to such severe shocks in the

financial markets?

The market's performance after the July rate hike leaves no doubt that the

Fed's expectations management has failed. The possibility of slowing the future

rate hikes has put the 75 basis point hike in vain.

The market is overly optimistic, but any Powell statement that is not hawkish

enough will be interpreted as dovish, and even on the eve of the meeting, there

seems to be a naive hope that the Fed's rhetoric will take a turn.

However, Powell’s speech in the meeting completely waked

up the market, and destroyed all the previously unrealistic fluke.

And there is a growing realization that the Fed will not adjust its current

hawkish stance until it achieves its goal of fighting inflation and that high-interest

rates may be maintained for a significant period, rather than the previously

speculated rate cuts that could begin in the middle of next year.

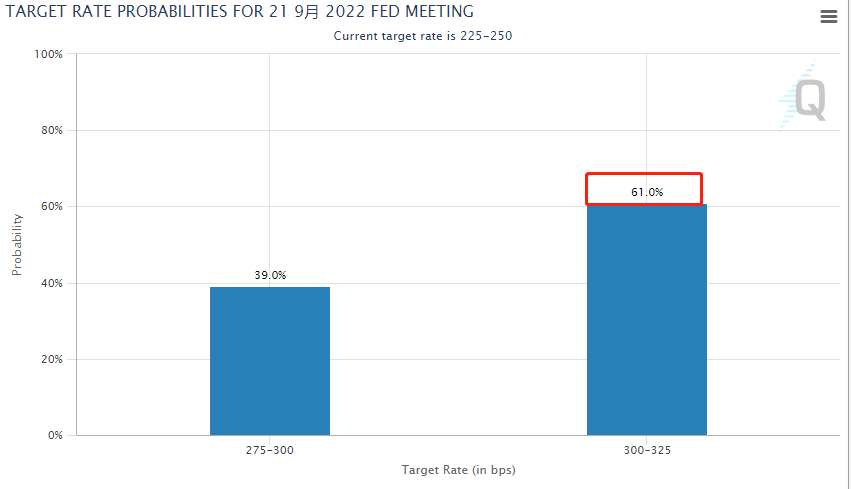

The likelihood of a September 75 basis points rises

After the meeting, the 10-year Treasury bond yield was firmly above 3%, and the

reversal in the 2- to 10-year Treasury bond yield deepened, with the

probability of a 75 basis point rate hike in September rising to 61% from 47%

previously.

Image source: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

On the day of the meeting, immediately prior to

Powell's speech, the Commerce Department announced that the PCE price index for

personal consumption expenditures rose 6.3% year over year in July, below the

6.8% expected in June.

Although the PCE data shows moderation in price growth, the possibility of a 75

basis point rate hike in September should not be underestimated.

This is partly because Powell repeatedly emphasized in his speech that it is

premature to conclude that "inflation has turned downward" based on

only a few months of data.

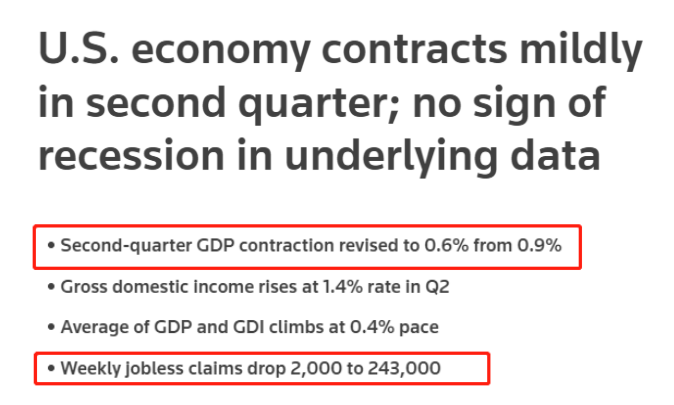

Second, the economy remains strong as GDP and employment data continued to be

revised upward, reducing market fears of a recession.

Image source: https://www.reuters.com/markets/us/revision-shows-mild-us-economic-contraction-second-quarter-2022-08-25/

After this meeting, there will likely be a change

in the way expectations are directed toward Fed policy.

"The decision at the September meeting will depend on the overall data and

economic outlook," in the case of high economic and inflationary

uncertainty, "talk less and watch more" may be a better choice for

the Federal Reserve.

Markets are more misled now than at any time this year, and the final round of

employment and inflation data before the September rate meeting will be

especially important.

We can only wait and see on this data and whether it can shake the already

determined 75 basis point rate hike in September.

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1376