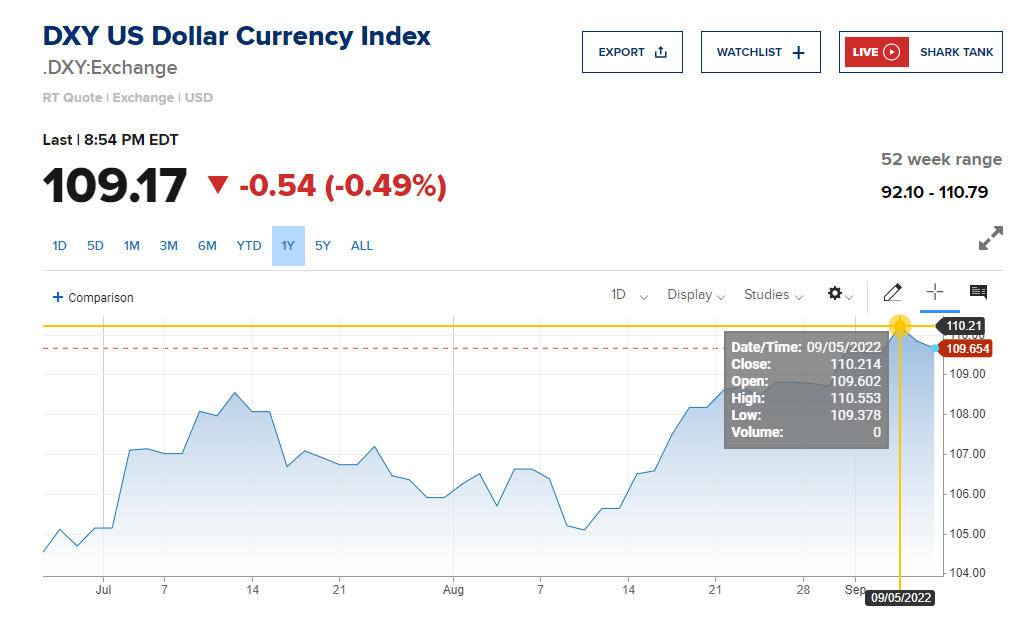

Dollar index soars to new 20-year high

On Monday, the ICE dollar index temporarily rose above the 110 mark, reaching a new high in nearly 20 years.

Image source: https://www.cnbc.com/quotes/.DXY

The U.S. Dollar Index (USDX) is used to calculate the combined rate of change of the U.S. dollar against other selected currencies to measure the degree of strength of the U.S. dollar.

This basket of currencies consists of six major currencies: the Euro, the Japanese Yen, the British Pound, the Canadian Dollar, the Swedish Krona and the Swiss Franc.

The increase in the dollar index indicates that the ratio of the dollar to the above currencies has risen, which means that the dollar has appreciated and the main international commodities are denominated in dollars, so the corresponding commodity prices are falling.

Apart from the important role played by the dollar index in foreign exchange trading, its position in the macroeconomics should not be ignored.

It gives investors an idea of how strong the U.S. dollar is in the world, which affects global capital flows and influences stock and bond markets, among others.

It can be said that the dollar index is a reflection of the U.S. economy and a weather vane for investments, which is why it is watched by the global market.

Why does the dollar keep re-valuating?

The rapid spike in the dollar since this year began when the Federal Reserve indicated - at the expense of economic growth - that it would fight inflation by raising interest rates rapidly.

This triggered a wave of selling in the stock and bond markets and drove U.S. bond yields as investors fled to the U.S. dollar as a safe haven, eventually driving the dollar index to levels not seen in decades.

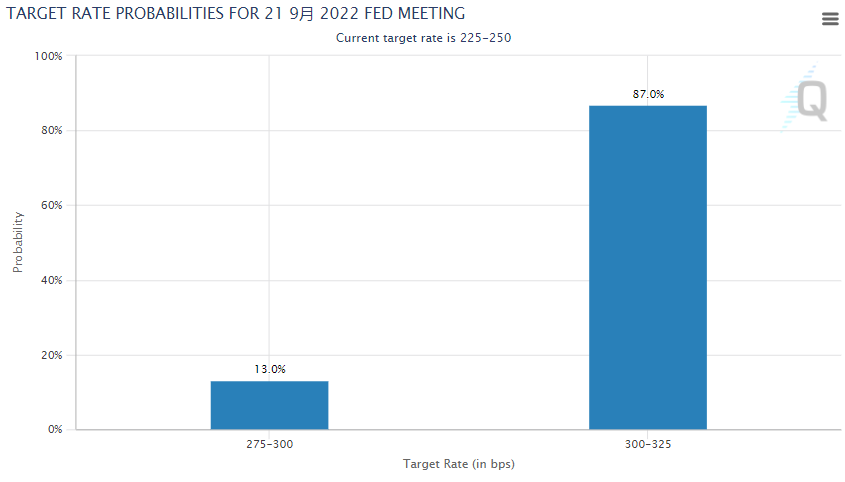

With Powell's recent hawkish statements of "fighting inflation without stopping", many now expect the Fed to keep raising interest rates through 2023, with the end point likely to be around 4%.

The yield on two-year U.S. bonds also broke through the 3.5% barrier last week, the highest level since the outbreak of the global financial crisis.

Image source: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

So far, expectations of a 75 basis point rate hike in September have been as high as 87%, and the Fed will continue to raise rates to entice investors to shift money from countries where rates are still low to the U.S.

On the other hand, the euro, which is largest component of the dollar index, has the greatest impact on it, while the energy crisis in Europe has escalated again with the current disruption of gas supplies from Russia to Europe.

But on the other hand, the consumption and employment data in the U.S. have developed well, and the risk of recession is low, which also makes the dollar assets more sought-after.

At present, it seems that the Fed's tough rate hike policy is like an arrow on the bowstring, the situation in Russia and Ukraine is unlikely to be reversed in the short term, Dollar is likely to maintain a strong pace, and is even expected to exceed the 115 high.

What are the opportunities created by the devaluation of the RMB?

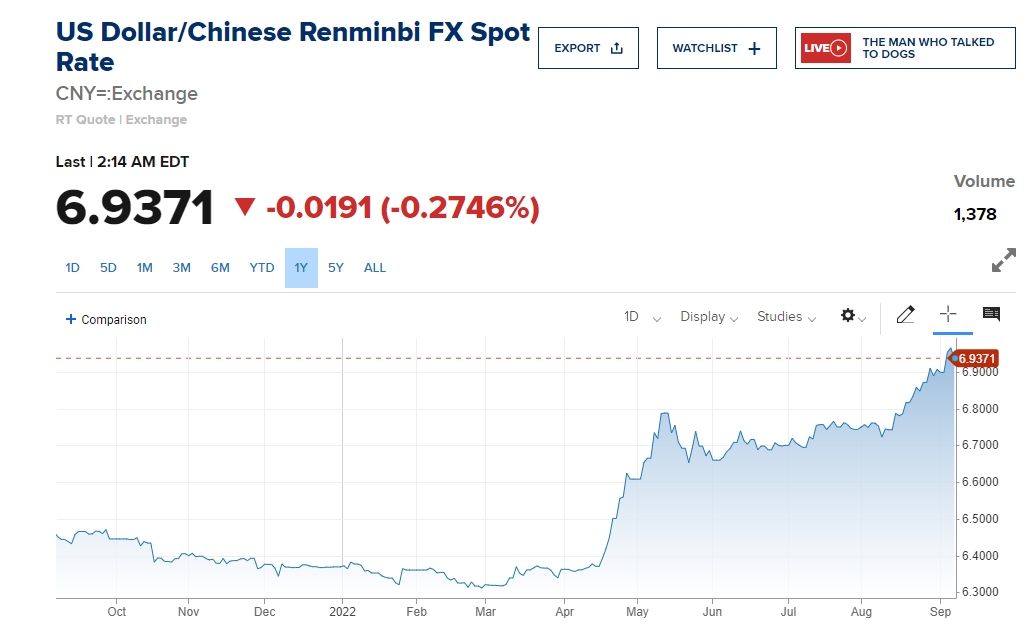

The rapid appreciation of the U.S. dollar has led to a general devaluation of the currencies of the world's major economies, from which the RMB exchange rate has not been spared.

As of September 8th, the yuan's offshore exchange rate has weakened 3.2 percent in a month to 6.9371, and many fear it may fall below the important 7 level.

Image source: https://www.cnbc.com/quotes/CNY=

To ease pressure on the depreciating yuan, China's central bank has also cut the reserve requirement ratio for foreign currency deposits - from 8 percent to 6 percent.

In general, a depreciating exchange rate boosts exports, but it also leads to a depreciation of assets denominated in the local currency - a depreciation of the RMB leads to a contraction of assets.

Shrinking assets are not good for investment, and the money in the accounts of wealthy individuals will shrink along with them.

To preserve the value of the money in their accounts, seeking overseas investment has become an increasingly popular way for high net worth individuals to preserve the value of their existing funds.

At this stage, when Chinese economy is weak, the RMB is depreciating and the USD is appreciating significantly, investing in U.S. real estate is becoming a hedge for many people.

Chinese buyers purchased $6.1 billion (or more than RMB 40 billion) worth of U.S. real estate last year, up 27 percent from the previous year, according to NAR.

In the long run, a developing trend for Chinese investors is to increase the proportion of overseas asset allocation.

For the mortgage market, this is likely to bring further new opportunities and possibilities.

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1441