Origin of the Prime Rate

Prior to the Great Depression, lending rates in the U.S. were liberalized, and each bank set its own lending rate by considering the cost of funds, risk premiums, and other factors.

In 1929, the U.S. entered the Great Depression - as the U.S. economy deteriorated, businesses closed in large numbers, and residents' incomes fell.

Thus, an imbalance between the supply and demand of capital emerged in the market, and the number of creditworthy businesses and recipients of quality credit declined rapidly. However, the banking sector had a surplus of capital and needed to find a place to invest.

In order to maintain the volume of loans, some commercial banks began to deliberately lower credit standards, some poorly qualified companies were also included in the target group of loans, banks competed for corporate customers and even began to offer interest rate discounts.

The resulting bank billing led to a significant increase in non-performing assets as banks with broken capital chains went bankrupt, further exacerbating the recession.

To prevent malicious competition among banks and to regulate the savings and loan market, the Federal Reserve introduced a number of measures, one of which is the prime lending rate - the Prime Rate.

This policy advocates setting a single benchmark interest rate to serve as a minimum interest rate for loans, and banks should lend at rates above this optimal lending rate to stabilize the market order.

How is the Prime Rate calculated?

The Loan Prime Rate (hereafter referred to as LPR), is the interest rate that commercial banks charge for loans to their customers with the highest credit ratings - these most creditworthy borrowers are typically some of the largest corporations.

In the 1930s, at the initiative of the Wall Street Journal, the LPR was calculated by weighting 22-23 quotes from the 30 largest commercial banks in the United States, selected according to the rules for determining the LPR of the market, and published regularly in the paper edition of the Wall Street Journal, and this published Prime Rate represented the lower limit of all lending rates in the market.

The mechanism for determining the LPR rate evolved over nearly eighty years: Originally, most banks quoted the Federal Funds Target Rate (FFTR) when banks had a high degree of freedom to regulate interest rates.

In 1994, however, the Federal Reserve agreed with commercial banks that the LPR would take the form of a full fix to the federal funds target rate, with the formula being Prime Rate = Federal Funds Target Rate + 300 basis points.

This 300 basis points is an intermediate value, meaning that the spread between the Prime Rate and Federal Funds Rate is allowed to fluctuate slightly above and below 300 basis points. For most of the period since 1994, this spread has been between 280 and 320 basis points.

Beginning in 2008, as the banking sector became more concentrated and most banks were actually controlled by a handful of banks, the number of banks listed for the LPR was reduced to ten, of which the LPR rates published on Wall Street changed when the prime rates of seven banks' changed.

With the introduction of this quotation mechanism, commercial banks almost completely lost their autonomy in adjusting the Prime Rate.

Why should I care about the Prime Rate?

The Prime Rate, published by the Wall Street Journal, is an indicator of interest rates in the U.S. and is used as the base rate by more than 70% of banks.

Interest rates on consumer loans are typically built on this prime rate, and when this rate changes, many consumers will also see changes in interest rates on credit cards, auto loans, and other consumer loans.

We just mentioned that the calculation of the prime rate is derived from the Federal Funds Target Rate + 300 basis points, and the “Federal Funds Target Rate” is the Fed’s “Interest” in booming rate hikes this year.

After the Fed raised rates for the third time in September by 75 basis points, the prime rate rose to 3% to 3.25% and added the additional 3% of prime rate is basically the current minimum for the lending rate in the market.

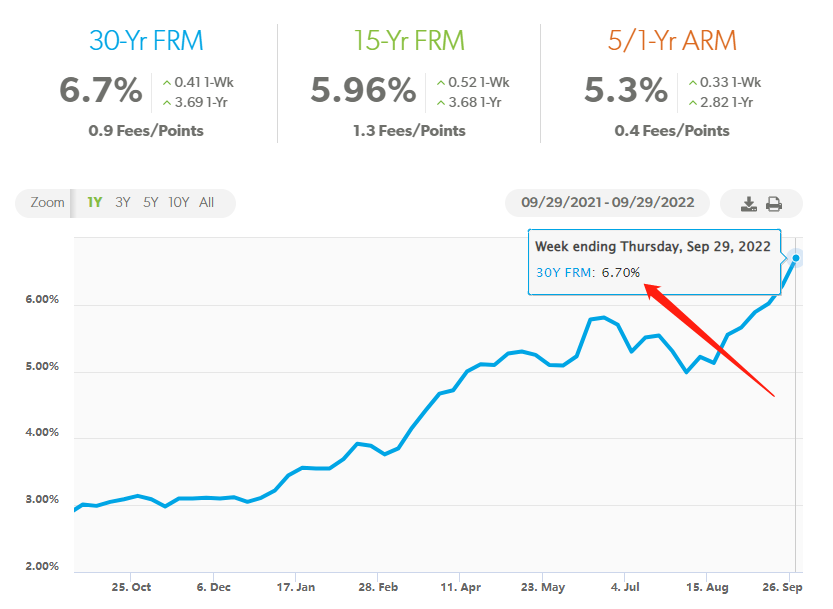

Image source: https://www.freddiemac.com/pmms

On Thursday, Freddie Mac reported a 30-year fixed mortgage rate averaging 6.7% - higher than our estimate of the prime rate.

The above calculation also gives us a better understanding of how the impact of the rate hike was transmitted so quickly to the mortgage market.

Changes in the prime rate will also have a more direct impact on some home loans, such as adjustable rate loans, which are adjusted annually, and Home Equity Loans (HELOCs), which are tied directly to the prime rate.

Having understood the “past life” of the prime rate, it is more helpful for us to monitor the trend in mortgage rate, and given the Fed’s ongoing rate hike policy, homebuyers with credit needs should start early to avoid missing a good time to secure a lower rate.

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1366