Why has not inflation come down?

Last Thursday, the Bureau of Labor Statistics released data for September CPI.

The CPI rose 8.2% year-on-year in September, compared to 8.3% previously, and 8.1% expected by the market; core inflation CPI rose 6.6% year-on-year, compared to 6.3% previously.

Headline inflation CPI has fallen since its peak in June this year, mainly due to lower energy prices, especially for gasoline, but also to a gradual slowdown in commodity inflation.

Surprisingly, however, core inflation CPI has reached a new 40-year high, rising for two consecutive months.

The main factor driving up core inflation CPI is housing inflation, which has reached 6.6% year-on-year, the highest level since records began, and rent inflation, which has also reached a record high of 7.2%.

How are rents driving up inflation?

After the 2020 pandemic, the real estate market began a "crazy cycle" due to extremely low interest rates, the need for telecommuting, and the wave of home purchases by Millennials. - At the beginning of this year, real estate prices rose by over 20%.

Although housing prices are not included in the calculation of CPI, the rise in housing prices has driven up rental prices, and the weight of rental inflation in the CPI is more than 30%, so rental prices continue to rise and have become the main “trigger” for the current high inflation.

In addition, mortgage rate have almost “doubled” year-on-year as a result of the Federal Reserve’s tough rate hike policy, and raging real estate prices are showing the first signs of a turnaround.

Currently, many buyers are choosing to take a wait-and-see approach due to rising borrowing costs; home prices have fallen in many areas, and many potential sellers are in no hurry to sell their homes, which as led to a sluggish real estate market.

When fewer people buy homes, more people rent them, further driving up rents.

The rise in rents may be peaking!

According to the Watch Rent Index published by Zillow, rent growth has been declining for several months in a row.

Historically, however, this rent index tends to precede apartment rents at CPI by about six months.

This is because Zillow only considers the prices of new leases signed in the current month when looking at the rent index, whereas most tenants sign one-or-two-year leases at a fixed monthly price, so CPI’s statistics also include the amount of leases already signed in the past.

There is a lag between current market rents and what most tenants actually pay, which is why the Bureau of Labor Statistics continues to report rising housing costs.

Based on experience, the rate of growth in residential rents in CPI will begin to slow in the 4th quarter of this year.

With rent inflation weighing in at over 30% in CPI, slowing rent growth will be key to bringing core inflation down.

New warning of rising interest rates

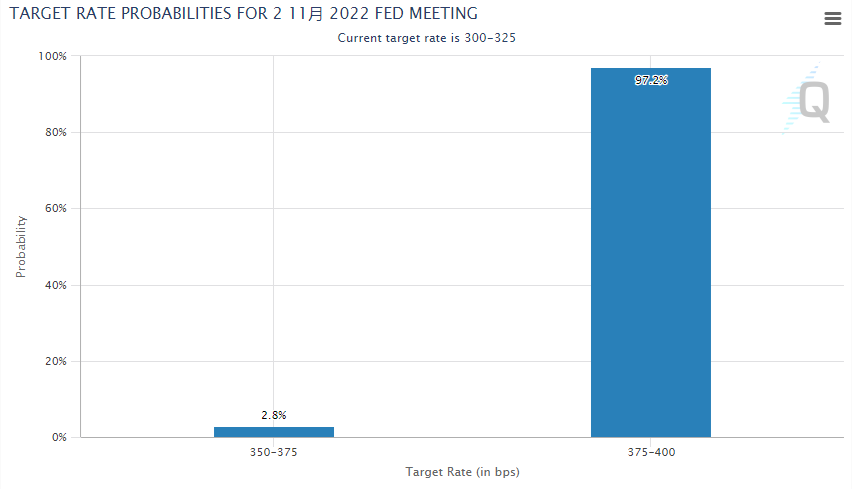

As CPI shows that inflation is still very hot, this also reinforces the expectation of another 75 bps rate hike in November (close to 100%); there is even speculation of another 75 bps rate hike in December ( which is expected to be as high as 69%).

Image source: https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

On September 12th, the Fed released the minutes of the September rate meeting, which reflect one core thing in particular - the Fed tends to raise rates to restrictive levels for the economy in the short term (this restrictive level must be above 4%). which explains exactly why the Fed needs to raise rates so aggressively in succession.

In other words, the Fed will raise rates significantly by at least another 125 basis points (75bp+50bp) before the end of the year and then maintain this level of rates for some time next year.

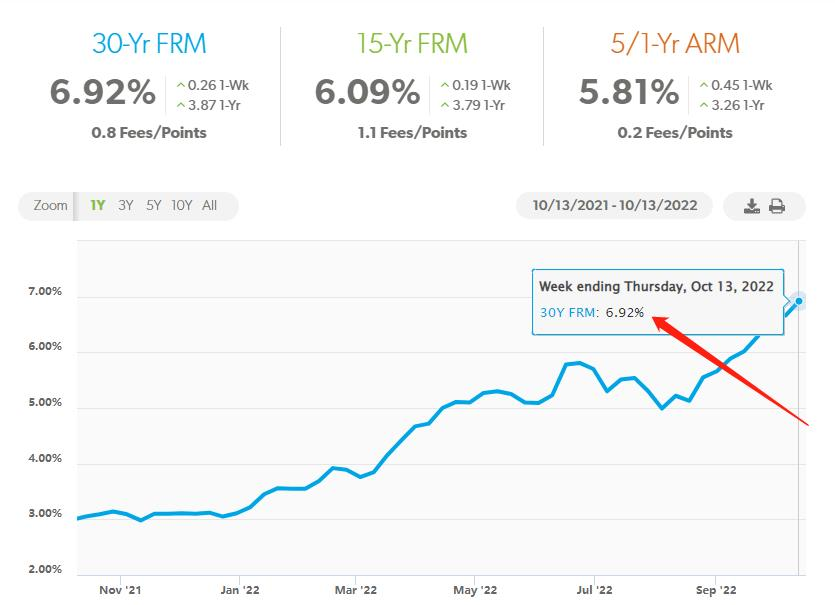

Image credits.https://www.freddiemac.com/pmms

Image source: CNBC

Go to on Thursday, Freddie Mac's newly announced thirty-year fixed rate rose to 6.92%, its highest level since 2002, and the ten-year Treasury bond yield also broke through the key 4% level.

Yun, chief economist of the National Association of Realtors (NAR), said according to a technical analysis, the next resistance will be 8.5% once home loan interest rates break through the 7% threshold.

With a new round of rate hikes on the horizon, it is wise to take advantage of the window of opportunity and contact your loan officer as soon as possible to lock in the still-low rates.

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1448