The Federal Reserve’s determination to curb inflation has recently led to a tightening of rate hike policy, with the result that U.S. bond yields have reached another multi-year high.

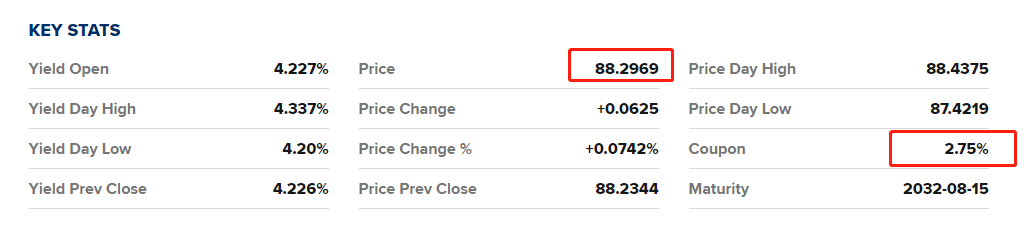

Image source: CNBC

The yield on the 10-year U.S. bond climbed to 4.21% on October 21, a new high since August 2007.

U.S. bond yields have been the focus of interest on the world markets, and the steep rise this year was taken as a warning signal, leading to dramatic volatility on the financial markets.

What is so Terror-stricken about the development of this indicator that it has the market in an uproar?

Why should I focus on the 10-year U.S. bond?

A U.S. bond is a bond issued by the U.S. government, essentially a promissory bill.

It is endorsed by the U.S. government and is considered a risk-free asset in the world and is highly regarded.

And the yields that we see on U.S. bonds are actually derived from the relevant calculations.

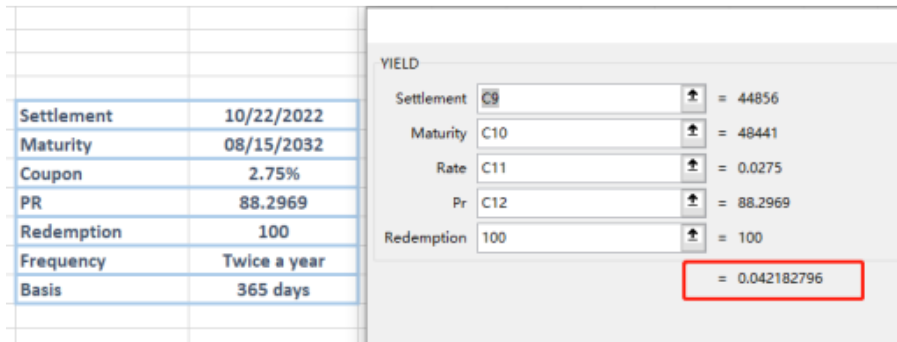

For example, the current price of the 10-year U.S. bond is 88.2969 and the coupon rate is 2.75%. That means if you buy this bond at that price and hold it to maturity, the interest income is $2.75 per year, with two interest payments a year, and if you redeem it at maturity at the coupon price, your annual return is 4.219%.

At the same time, short-term U.S. debt is very vulnerable to political and market influences, while too long-term U.S. debt is too uncertain and illiquid.

The ten-year U.S. bond is the most active of all maturities and is also the basis for bank lending rates, including mortgages, and yields on all types of assets.

A a result, the yield on the 10-year U.S. bond is widely recognized as the “risk-free rate” that determines the lower bound on asset yields and is considered the “anchor” for asset pricing.

The recent sharp rise in U.S. bond yields continues to be largely due to the Federal Reserve’s continued interest rate hike.

So what exactly is the relationship between interest rate hikes and rising Treasury bond yields?

In a rate hike cycle: bond prices move closely with the evolution of the issuance rate.

A rise in interest rates on new bonds leads to a sell-off in old bonds, a sell-off leads to a decline in bond prices, and a decline in prices leads to an increase in the yield to maturity.

In other words, the same interest rate that used to buy for $99 is now buying for $95. For the investor who buys it for $95, the yield to maturity increases.

What about the real estate market?

The jump in the yield on 10-year U.S. bonds has driven up mortgage rates.

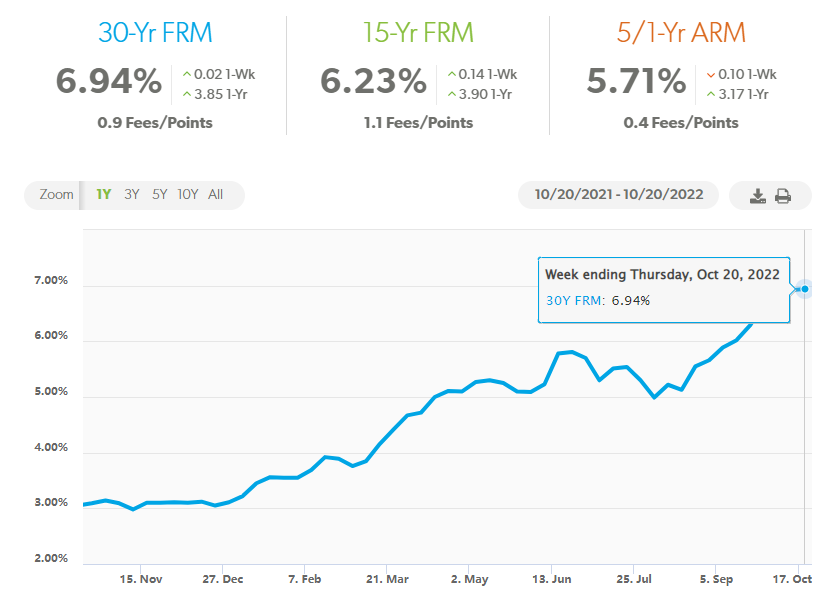

Image source: Freddie Mac

Last Thursday, Freddie Mac reported that the interest rate on 30-year mortgage rose to 6.94%, threatening to break the all-important 7% barrier.

The burden of purchasing a home is at an all-time high. According to the Federal Reserve Bank of Atlanta, the average U.S. household now has to spend half of its income on home purchases, nearly tripling in two years.

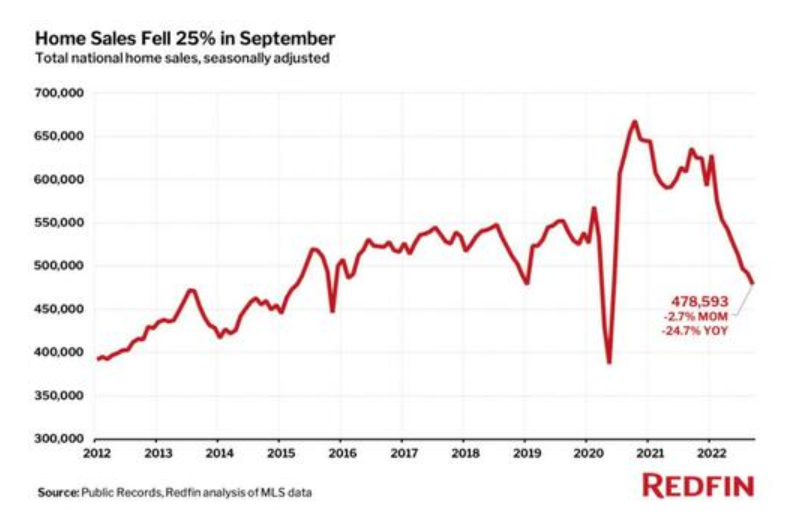

Image credit: Redfin

Given this heavy burden on home purchases, real estate transactions have stalled: Home sales fell for the eighth consecutive month in September, and mortgage demand fell to its lowest level in 25 years.

Until there is a turning point in the rise of mortgage rates, it is hard to imagine the real estate market recovering.

So we can make a prediction of mortgage rates from the development of 10-year Treasury yields.

When will we peak?

Looking at historical rate hike cycles, the 10-year U.S. bond yield has exceeded the end rate of increase at the peak of the rate hike cycle.

The dot plot for the September rate meeting suggests that the end of the current rate hike cycle will be around 4.5 - 5%.

Nevertheless, the yield on 10-year U.S. bonds should still have room to rise.

In addition, in the interest rate hike cycles of the past 40 years, the yield on 10-year U.S. bonds has usually peaked about a quarter before the policy rate.

This means that the yield on 10-year U.S. bonds will be the first to fall before the Fed stops raising interest rates.

Mortgage rates will also reverse their upward trend at that time.

And now may be the "darkest hour before dawn."

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1537