On November 29th, the Federal Housing Finance Agency (FHFA) announced updated Conforming Loan Limits for conventional mortgages for 2023.

The 2023 conventional mortgage limits are effective immediately and the following criteria apply.

Conventional loan limits will increase from $647,200 in 2022 to $726,200 in most areas of the U.S., an increase of about 12 percent; limits in higher-priced areas will also increase, from $970,800 to $1,089,300. *For 1 Unit homes

Image source: CBS NEWS

This is the first time in history that the U.S. federal government has begun to support home loans over $1 million, which is a very important sign! It is also significant for all home buyers.

So what exactly is the Conforming Loan Limit (CLL)?

What is the conventional loan limit?

To understand what a conventional loan limit is, we must first understand what a conventional loan (Conforming Loan) is.

Conforming loans are the most common type of loan in the U.S. market today, and most buyers apply for this type of loan.

These loans are typically less stringent in terms of buyer requirements and are simply government assistance for buyers with lower purchase prices, allowing buyers with lower credit scores and lower down payments to purchase a home.

By law, Conforming Loans are approved under the rules of Fannie Mae and Freddie Mac.

Both companies will put such loans as Mortgage-backed securities (MBS) and sell them to investors on the open market.

Due to the higher liquidity and government support, the interest rate of conforming loans is usually lower than that of Non-conforming loans and the approval is not as strict, but at the same time the loan amount you can get for this type of loan will not be too big.

So a Conforming loan is a mortgage that meets the loan amount criteria set by Fannie Mae and Freddie Mac, and Fannie Mae and Freddie Mac can only purchase mortgages below that loan limit.

The limits, are set by the Federal Housing Finance Agency (FHFA).

How are limits set for conventional loans?

As home appreciate in value over time, the Housing and Economic Recovery Act (HERA), passed by the U.S. government in 2008, provides for annual adjustments to conventional loan limits and establishes a permanent formula for loan limits to account for changes in average home prices in the United States.

The limit is set by the Federal Housing Finance Agency (FHFA), which looks at the percentage change in average home prices from the previous year reported by the Federal Housing Finance Board (FHFB) in October of each year to adjust the conventional loan limit, which is announced the following November.

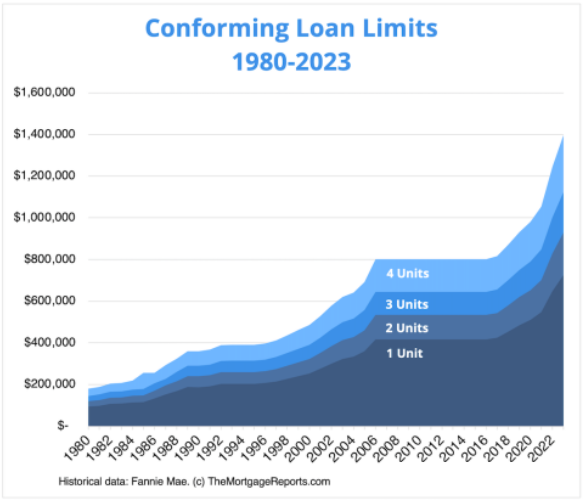

The chart below shows the change in Conforming Loan limits from 1980 to 2023, applicable to most of the United States.

Image source: TheMortgageReports.com

Since the beginning of 2020, the 2023 conventional loan limit has also seen a significant boost as demand for residential real estate has surged due to record low mortgage rates and the trend to work from home, and average home sales prices in the U.S. have increased by nearly 40%.

While FHFA sets the baseline for conventional loan limits, each county has its own conventional loan limits.

This is because in some areas where home prices are above the national average, such as New York City, Seattle, and San Francisco, the median local home value has reached 115% or more of the conventional loan limit.

In these areas, FHFA allows higher amounts to be borrowed for conventional loans (Super Conforming Loans), also known as High Balance Loans.

For High Balance Loans, the HERA further requires that the maximum borrowing not exceed 150% of the Conforming Loan limit.

Using four statutorily designated high cost areas as examples of Alaska, Hawaii, Guam, and the U.S. Virgin Islands. The 2023 High Balance Loan limit is 150% of the Conventional Loan limit, or $1,089,300. ($726,200*150%=$1,089,300)

How does this affect homebuyers?

Higher conventional loan limits mean that homebuyers can more easily meet conventional loan requirements, and conventional loans that meet the limits typically have lower APRs and lower monthly payments for borrowers.

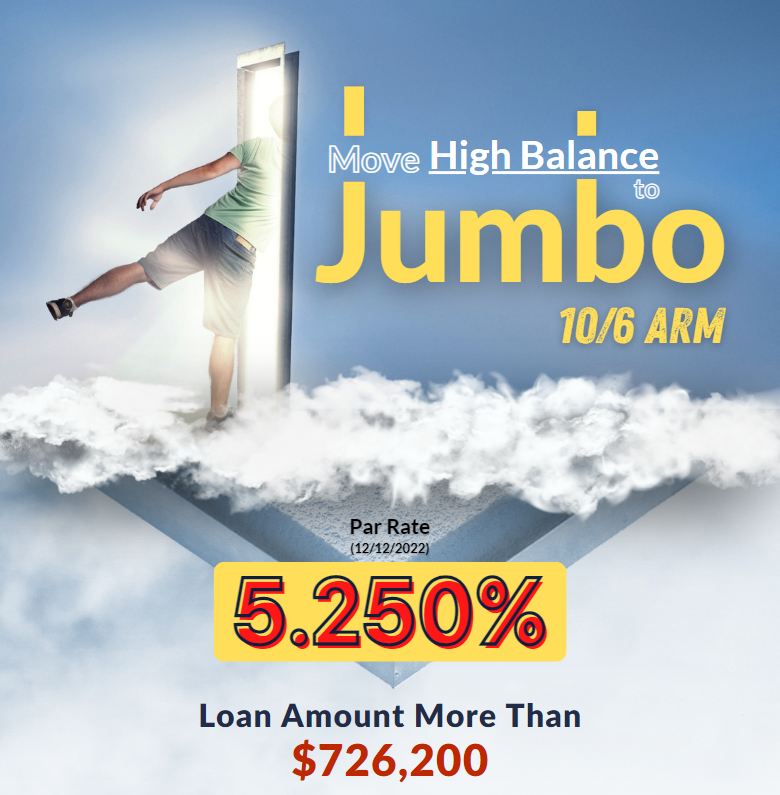

Loans that exceed the caps on conventional loan limits are generally referred to as Jumbo Loans, which typically have higher interest rates than Conforming Loans .

But with the Fed's six hefty rate hikes over the year, interest rates on conventional loans have generally soared. According to the latest statistics from Freddie Mac, the average interest rate on a 30-year fixed-rate mortgage is 6.49%, double what it was at the beginning of the year!

Photo credit: Freddie Mac

But now AAA LENDINGS is offering a Jumbo Loan product with interest rate as low as 5.375%!

In addition to this, you can currently apply for this type of loan as long as the loan amount is above the Conforming Loan Limit.

Such a low interest rate is not often found on the market. So if you qualify, APPLY EARLY!

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1483