On December 16, the Federal Reserve adopts final rule that implements Adjustable Interest Rate (LIBOR) Act by identifying benchmark rates based on SOFR that will replace LIBOR in certain financial contracts after June 30,2023.

Image source: the Federal Reserve

LIBOR, once the most important number in financial markets, will disappear from history after June 2023 and will no longer be used to price loans.

Starting in 2022, many mortgage lenders' adjustable-rate loans are tied to an index - the SOFR.

How does the SOFR affect floating loan rates? Why should the SOFR be used instead of LIBOR?

In this article we'll explain what exactly the SOFR is and what are the main areas of concern when calculating adjustable interest rates.

Adjustable-Rate Mortgage Loans (ARM)

Given the current high interest rates, many people are opting for adjustable-rate loans, also known as ARMs (Adjustable-Rate Mortgages).

The term "adjustable" means that the interest rate changes over the years of the loan repayment: A fixed interest rate is agreed upon for the first few years, while the interest rate for the remaining years is readjusted at regular intervals (usually every six months or a year).

For example, a 5/1 ARM means that the interest rate is fixed for the first 5 years of repayment and changes every year thereafter.

During the floating phase, however, the interest rate adjustment is also capped (caps), e.g. 5/1 ARM is usually followed by the three-digit number 2/1/5.

· The 1 refers to the cap for each interest rate adjustment except the first one (cap for subsequent adjustments), i.e. a maximum of 1% for each interest rate adjustment starting in year 7.

· The 5 refers to the upper limit for interest rate adjustments during the entire term of the loan (lifetime adjustment cap), i.e. the interest rate may not exceed 6% + 5% = 11% for 30 years.

Because the calculations of ARM are complicated, borrowers who are not familiar with ARMs often tend to fall into a hole! Therefore, it is very important for borrowers to understand how to calculate the variable interest rate.

What is the SOFR main areas of concern when calculating the floating rate?

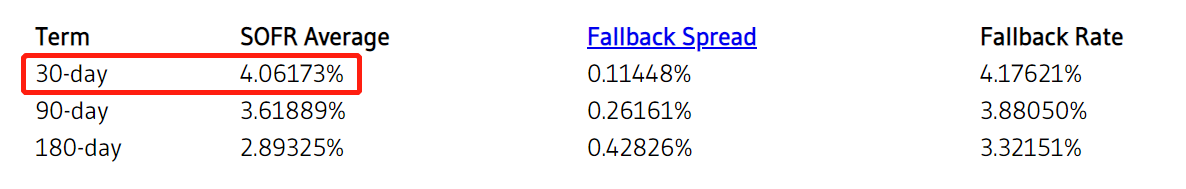

For a 5/1 ARM, the fixed interest rate for the first 5 years is called the start rate, and the interest rate starting in the 6th year is the fully indexed interest rate, which is calculated by index + margin, where the margin is fixed and the index is generally the 30-day average SOFR.

With a margin of 3% and a current 30-day average SOFR is 4.06%, the interest rate in the 6th year would be 7.06%.

Image source: sofrrate.com

What exactly is this SOFR index? Let us start with how adjustable rate loans come about.

In London in the 1960s, when inflation was skyrocketing, no banks were willing to make long-term loans at fixed rates because they were in the midst of rising inflation and there was significant upside risk to interest rates.

To solve this problem, banks created adjustable-rate loans (ARMs).

On each reset date, individual syndicate members aggregate their respective borrowing costs as a reference for the reset rate, adjusting the interest rate charged to reflect the cost of funds.

And the reference for this reset rate is LIBOR (London Interbank Offered Rate), which you often hear about - the index that has been referenced repeatedly in the past when calculating adjustable interest rates.

Until 2008, during the financial crisis, some banks were

reluctant to quote higher lending rates to cover up their own funding crisis.

This exposed the major weaknesses of LIBOR: LIBOR was widely criticized for

having no real transaction basis and being easily manipulated. Since then,

demand for borrowing between banks has fallen sharply.

Image source: (U.S. Department of Justice)

In response to the risk of LIBOR's disappearance, the Federal Reserve

formed the Alternative Reference Rates Committee (ARRC) in 2014 to find a new

reference rate to replace LIBOR.

After three years of work, the ARRC officially selected the Secured Overnight

Financing Rate (SOFR) as the replacement rate in June 2017.

Because the SOFR is based on the overnight rate in the Treasury-backed repo

market, there is almost no credit risk; and it is calculated using the

transaction price, making manipulation difficult; in addition, the SOFR is the

most traded type in the money market, which can best reflect the level of

interest rates in the funding market.

Therefore, starting in 2022, the SOFR will be used as the standard for pricing

most floating-rate loans.

What are the benefits of a adjustable rate mortgage loan?

The Federal Reserve is currently in a rate hike cycle and 30-year fixed mortgage rates are at high levels.

However, if inflation declines significantly, the Federal Reserve will enter an interest rate reduction cycle and mortgage rates will return to normal levels.

If market interest rates decline in the future, borrowers

can effectively reduce repayment costs and benefit from lower interest rates

without having to refinance by choosing a adjustable rate loan.

In addition, adjustable rate loans also typically have lower interest rates

during the commitment period than other fixed term loans and relatively lower

upfront monthly payments.

So in the current situation, a variable rate loan would be a good choice.

Articles Sharing:

Will Powell become the second Volcker?

When Record-high Home Prices Meet Crazy Interest Rate Hikes

Statement:

This article was edited and compiled by AAA LENDINGS, the copyright belongs to AAA LENDINGS website, it doesn't represent the position of this website, and is not allowed to be reprinted without permission.

阅读原文 阅读 1879